- En

- Fr

- عربي

DSP Project in "Eléctricité du Liban"

Introduction

According to the World Bank[1], Lebanese citizens incur on average 220 interruptions of electricity per year, which is the worst performance in the Middle East. Today, electricity production stands at around 1,500 megawatts (MW) while demand exceeds 2,400 MW at peak times, resulting in rationing cuts from between 3 to 20 hours a day, depending on where you are in Lebanon[2].

The main reason behind choosing this topic is the dramatic deterioration of the power sector in Lebanon, especially after the commencement of the Distribution Service Provider (DSP) Project in "Eléctricité du Liban" (denoted by EDL). So it will be valuable to evaluate this experience and address the weaknesses & mistakes made in each stage before and during the project implementation, in order to take lessons for future by answering three important questions:

1. What are the drivers of adopting DSP Project ?

2. What are the main reasons behind the failure of DSP project?

3. How can we deal with the current status in light of negative consequences resulted by the DSP Project ?

Successively, the institutional approach that I have chosen to adopt led me to analyze the public private partnership (ppp) (chapter 1), the situation of EDL (chapter 2) and the DSP project analysis (chapter 3).

I- Public-Private Partnerships

1- Definition of PPP

Many definitions of the PPP[3] were made by economists and practitioners, but some of it will be mentioned in order to understand the typical notion:

• PPP is a common project established between the private party and the public party. The relationship is based on the experience of each sector in a way forming an obvious predefined public requirements associated with deliberate risk sharing.

• PPP means that public and private parties are agreed to share their power and skills to achieve a common interest.

• PPP is a collaborative model that aims to achieve public interest through a contractual engagement between the public party which lacks the capabilities, and the private party which is able to cover the public deficiency.

• The public sector in the partnership agreement may either contribute to the investments of the intended project or allow the usage of the main fixed assets for the operation process, while the private sector can use flexible styles of management that may not be available in the public sector, which often adopts bureaucracy.

• PPP means that each party of the partnership agreement has obligations and responsibilities to build or operate a public facility, and they have to allocate the potential risks between them according to their capacities and qualifications to achieve value for money.

2- Types of PPP agreements[4]

Public sector can apply several types of PPP agreement; this depends on the project requirements compared with the resources available in the public party, which usually seeks for the experience of the private sector that has better project and risk management (for instance: improving service quality, transferring risk, maintaining service control).

Public private partnership agreements have many forms. However some of it will be addressed as follows:

• Just Finance:

The public entity in this case has the capacity to design, build and operate the project; however he lacks the financial resources. The role of the private party here is restricted in ensuring the funds needed to carry out the public service or project.

These partnership agreements are usually made by the private financial institution that is able to lend long term loans.

• Operation & Maintenance Contract (O & M):

The role of the private party in this type of partnership agreement is to operate and maintain an already existing facility (or asset), and therefore the government may grant to the private party the right to charge tolls to the users in order to help finance the improved operation and maintenance of the facility. This partnership agreement has a determined time specified in the contract documents.

The public entity, in case of O&M, asks for private cooperation because he lacks the technical capacity to operate and maintain such facility. However the ownership of the facility remains public.

• Build & Finance:

In this type of partnership agreement, the private party undertakes only the role of constructing the asset. In addition to that, he is responsible for financing the capital cost throughout the construction time limit.

• Design-Build-Operate (DBO):

In this type of partnership agreement, the public entity provides the necessary funds to the private party which is responsible for designing, building and operating the facility.The private party is then paid a management fee according to performance standards. This type of partnership may be suitable for very large projects for which the private sector is unable to finance wholly.

• Design-Build-Finance-Maintain (DBFM):

In this type of partnership agreement, the private party is responsible for designing, building, financing and maintaining the asset, while the operating task remains under the responsibility of the public entity.

DBFM agreement is deemed a long term contract.

• Design-Build-Finance-Maintain-Operate (DBFMO):

This kind is a typical type of PPP agreement since the private party is responsible for designing, building, financing, operating and maintaining the asset. Such agreement is usually deemed a long term contract. The ownership of asset or facility in DBFMO remains public.

• Build-Own-Operate (BOO):

In this type of PPP agreement, the private party builds, owns and operates the facility with some degree of encourgement from the government. In such agreement, the government doesn't provide direct funding but it may offer some financial incentives such as tax-exempt status. Furthermore, the private party owns and operates the facility independently.

• Build-Operate-Transfer (BOT):

Under BOT, the private party builds, operates and then transfers the ownership of the facility to the public entity at the end of the operation period. Massive initial investment of private funding sources is therefore required from this private party and is to be repaid from the tolls collected from users.

• Build-Own-Operate-Transfer (BOOT):

A BOOT agreement is often seen as a way to develop a large public infrastructure project with private funding. In this type of partnership agreement, the private party designs and builds the facility (ex: airport, power plant...) to the public entity. Moreover, the private party owns and operates such facility for a specified period of time (defined in the PPP contract, usually from 20 to 30 years). However after that period the ownership of the facility will be reverted back to the public authority under a predetermined price.

•Build-Lease-Operate-Transfer (BLOT):

In this case, the private party is responsible for designing, financing and building the facility on a leased public land. In addition to that, the private party operates the facility for the duration of the lease and after that transfers the ownership to the public entity.

• Concession:

This type of agreement states that the public entity will give the private party the exclusive right to operate, maintain and make investments in certain public facility (ex: water plant concessions), for a given period of time, while the ownership of the asset will be reverted back to the public authority after the end of the contract. Moreover, the concessionaire agrees to pay a percentage ratio of the outcomes to the public entity according to the contract conditions.

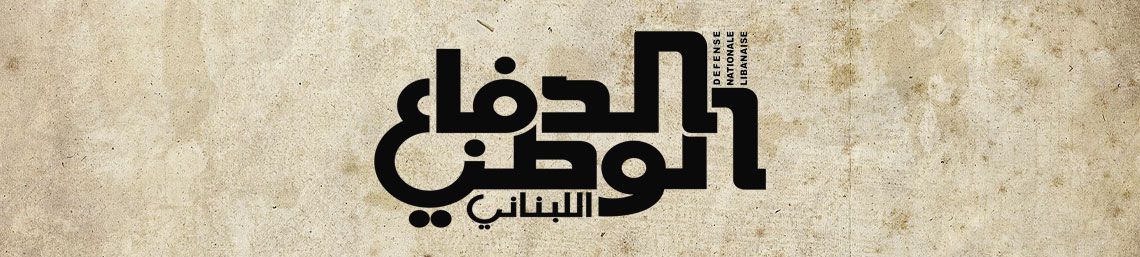

2- Models of Public-Private Partnerships

The forms of agreement between the public party and the private party differ according to the degree of private sector involvement from one side and the extent of risk sharing on the other side.

The following figure is a Canadian sample of PPP[5] classification and it shows a scale of PPP starting from the minimum level of private sector involvement to the maximum one which is privatization:

3- PPP Benefits

• Value for money

Compared to traditional procurement, PPP Projects have more opportunities to achieve value for money, which is deemed the essential goal of procurement. This fact can upgrade the quality level of the project and achieve the public interest without any additional funds.

• Allocation of risk

One of the probable advantages of adopting PPP is mitigating the potential risk that may arise during the project implementation by transferring it to the private sector. But since risk is sometimes costly, the public sector has to compare between the cost of bearing the risk and the cost of transferring it.

• Input v/s Output

Moving from input based contracts to output based contracts can deliver more flexible area for the private sector to select the inputs and the process that will lead to obtain the required output. This fact will encourage economic operators to be more competitive by reducing the input price as much as possible. On the other hand, using output specification will induce innovation since economic operators are not limited to adopt a certain process to deliver the service because the concern is the result rather than the mechanism.

• Access to private capital

That will lead to reduce government budget and budget deficit by taking the advantage of private investments.

• Quality

If planned properly, PPP can deliver better quality standards and services during the expected life of the project.

1.4 Challenges that surround PPP

Although PPP has many advantages, there are some challenges that face the partnership projects. Some of these challenges are addressed below:

• High capital cost to the private sector

One of the disadvantages in partnership projects is that the public sector can borrow funds with lower interest rate (for instance treasury bonds), while the private sector suffers from high cost of capital. This fact can probably affect the total cost of the project.

Moreover, the cost of potential risks in the field of building, operating and maintaining the project is not taken into consideration. However, in the case of private sector it will be regarded, causing further increase in the project’s total cost.

Therefore, the argument in this section states that the public sector can borrow funds at a lower interest rate than the private sector does.

• Return on investment

Any PPP agreement aims at achieving mutual benefits for both public and private parties, where public sector aims to attain public interest, and private sector seeks for making profit.

Hence, the return on investment is a critical element considered by the private party when making a partnership agreement, because he aims to maximize his profit as much as possible. In addition to that, the private party usually requires high rate of return on investment in order to cover the different risks that may arise during the project implementation.

It is important for the public sector to know that any project has unforeseen results. So he should balance between the rate of return on investment and keeping reasonable incentives for the private party in order to foster the participation of the greatest possible number of economic operators.

On the other hand, enhancing competition would help the public party to limit the exaggerated rate of return on investment submitted by the private parties, who would seek for innovation in order to reduce their operating costs.

• Limitation of transparency and accountability

During the implementation of the project, the public party seeks for maximizing accountability and transparency, while the private party does not consider these principles because he is less prone to reveal his expenditures and the way he operates due to confidentiality.

• The possibility of bankruptcy

Other essential risk that faces public private partnership agreement is the financial situation of the economic operator who is able to go bankrupt due to several unforeseen reasons. However, the public party can control this risk either in the tender preparation (review the financial standing and the historical projects of the economic operator) or by including the PPP contract deliberate penalties and securities which may reduce the potential damages in case of bankruptcy (for instance: asset liquidation).

The argument in this section states that bankruptcy remains a serious challenge for the public sector. However, it could be limited through tender preparation phase.

• Social consideration[6]

Another challenge that surrounds PPP projects is the fate of public employees after the commencement of the project. This issue must be discussed and treated in the sense of ensuring a fair fate for public workers. Otherwise, the project will be faced with strong resistance which may hamper the operation process and make it difficult.

Public & private parties have to agree in advance about the fate of public employees, and the possibility of dismissing or absorbing them into the new project.

• Political & economical stability

PPP agreement is usually established to mitigate the public party's burden and operate infrastructure projects. However, the political & economic stability remains the main challenge for the project to achieve its objectives, because economic fluctuations threaten the project financially, and thus lead to failure.

II- Situation Of "Eléctricité Du Liban" (Edl)

1- Introduction

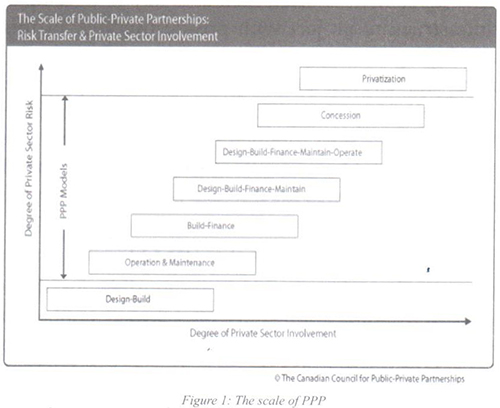

Eléctricité du Liban (denoted by EDL) is the only Lebanese public institution that is responsible for the production, transmission and distribution of electric power on all Lebanese territories. It has seven power production plants that work on either fuel or gas. The fuel consumption ratio represents approximately 33% (as an average) of the total imported national fuel, while in terms of dollars, this ratio is about 475 million USD in 2004 & 900 million USD in 2006 .[7] (see figure 2 below)

Lebanon currently encounters an energy challenge that influences its overall economy. This is because the power sector is not able to cover all the domestic demand due to its aging power generation plants which have limited capacity, in addition to their costly maintenance. The total supply of EDL is around 1500 mega watts, while the total demand that is required in Lebanon to ensure a continuous power feeding is about 2300 mega watts. However, this gap is prone to be aggravated because of the increasing demand on electric power as a result of population growth and Syrian refugees crisis.

Furthermore, the energy sector has a poor technical situation, since it relies on inefficient assets that are used for the purpose of producing energy. On one side this fact is affecting negatively the electric supply process, and on the other side, it increases the EDL’s burden due to the high rehabilitation cost of these assets.

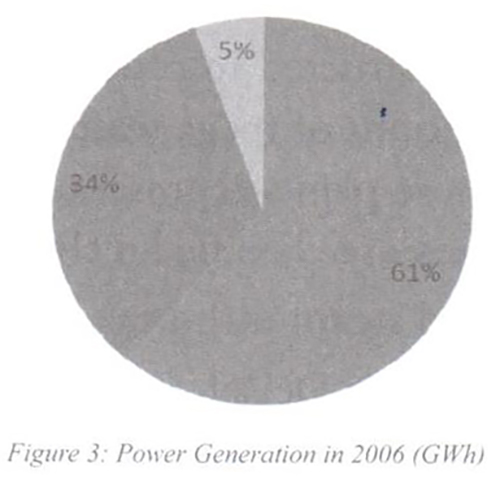

Currently, most end users in Lebanon are relying on private generators in order to compensate the deficiency of the public power supply. (see figure 3 below)

Since Lebanon does not produce oil (at least until the present time), EDL is fully relying on the imported fuel to maintain power production, where the continuous rise in oil prices is making matters worse and worse[8], especially with the absence of any alternative resource.

The situation of EDL is assessed along four dimensions:

2- Technical situation: It is mainly associated with generation and transmission status.

a- Generation:

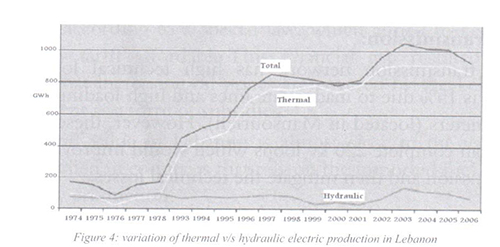

There are two types of power generation in Lebanon. The first one is generating through thermal plant, and the second one is generating through hydraulic plant. In addition to that, there is the outsourcing energy which is transmitted from Egypt (527 GWH[9]) and Syria (589 GWH), and such imported energy represents 7.5% of the national electric production.

• Hydraulic plants:

Hydraulic plants (Barid, Ibrahim & Litane), are constructed to produce 274 mega watts. However, the actual amount produced currently is 190 mega watts. These plants represent 4.5% of the national electric production.

• Thermal Plants:

Thermal plants are constructed to produce 2083 mega watts. However, the actual amount of mega watts produced currently is 1685 mega watts. These plants represent 88% of the national electric production. They are classified technically as follows:

- Zouk and Jieh as fired steam turbines.

- Baddawi & Zahrane as Deisel fired combined cycle gas turbine.

- Baalbek & Sour as diesel fired open cycle gas turbine.

The fluctuation of fuel cost per KWh ranges between 9 USC[10] to 22 USC. Figure 4 below illustrates the variation of thermal & hydraulic production in Lebanon.[11]

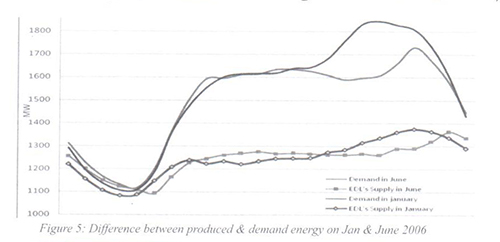

In 2009, the average monthly demand was 2100 mega watts, while the average monthly supply was 1500 mega watts, knowing that demand’s summer period was 2450 mega watts.

The total annual demand in 2009 was 15000 GWh, while the total annual supply & import of electric power was 11522 GWh. This shows a supply gap of 3478 GWh.

In general, the capital city of Lebanon is supplied with electric power for 21 hours /day, but the other regions are supplied with 16 hours/day.

The generation mechanism is deemed costly compared to other mechanisms, in addition to the very old power plants that need continuous and costly maintenance (Figure 5 below shows the gap between supply & demand during two months in 2006)[12].

b- Transmission:

The transmission network has high technical losses rate which is 15% due to inadequate lines and high loading. It lacks 1920 meters (located in Mansourieh). However, these missing lines can complete 220 kv loops which would improve electric transmission and then mitigate the technical losses.

3- Financial situation:

EDL has had a very bad financial situation for many years. The annual budget deficit is estimated around 400 million USD. This gap is covered yearly by the government’s support as a form of subsidies.

The deterioration of the financial situation is primarily due to the law of fixing electrical tariff value despite the continuous rise in oil prices.

In Lebanon, 20% of the national debt is occurred by EDL deficit, which means that this sector needs a remedial action plan to reduce the financial gap.

a- Tariff structure:

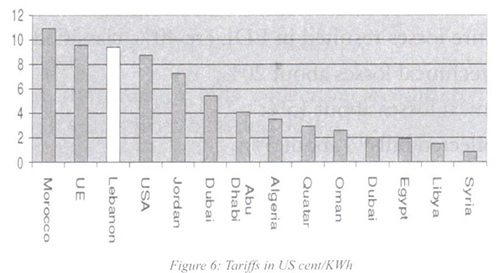

Lebanon’s electricity tariffs are high compared with regional standards and the quality of services provided, but they are considered too low to cover all the costs of EDL. Most power produced in Lebanon is thermal-based generation. Accordingly, the tariff value depends on oil price. There are 3 basic tariff values: low voltage tariff, medium voltage tariff and high voltage tariff.

The value of electricity tariff in Lebanon is correlated with oil price. However, the current tariff value was established when the price of oil barrel was 25$. And despite the huge increase in the price of oil barrel (until the end of 2014), the tariff remains constant according to a special law, which aimed to keep the electricity tariff affordable.This financial gap resulted from the fact that increasing oil prices are covered by the Lebanese government as a form of subsidies.

The tariff value in Lebanon is almost close to the value of tariffs applied in countries that rely on the imported fuel oil for electricity production.

Figure 6 below shows the variation of tariff value among different countries.[13]

b- High cost of fuel:

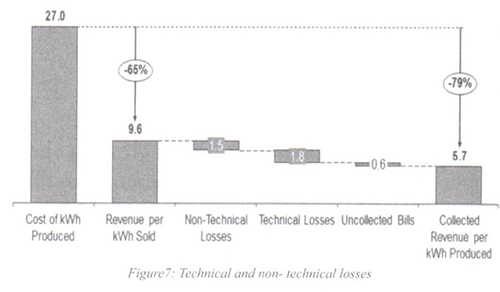

The cost of KWh produced compared to the revenue per KWh sold is too low due to the high cost of fuel and to the low tariff, in addition to other losses (see figure 7 below).

The contribution of fuel cost to the total cost structure of EDL is very high as explained previously. For instance, the total cost of fuel in 2008 was 11450 million USD which represented 75% of the total operation cost.

While in 2009, it was 1165 million USD which represented 62% of the total operation cost.

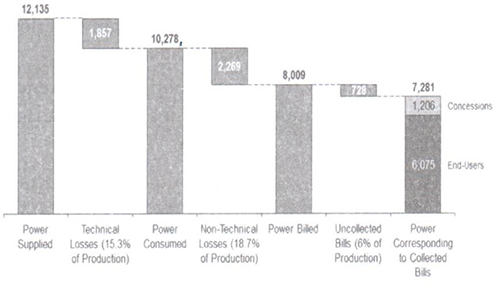

c- Losses:[14]

The entire losses resulted in EDL are 40%, classified as:

- Non technical losses about 20%;

- Technical losses about 15%;

- Uncollected bills[15] about 5%;

The World Bank Group defines the technical wastes as “occur naturally and consist mainly of power dissipation in electricity system components such as transmission and distribution lines, transformers and measurement systems”, while the non-technical wastes: “are caused by actions external to the power system and consist primarily of electricity theft, non-payment by customers and errors in accounting and record-keeping”.

• Non technical wastes and bills collection:

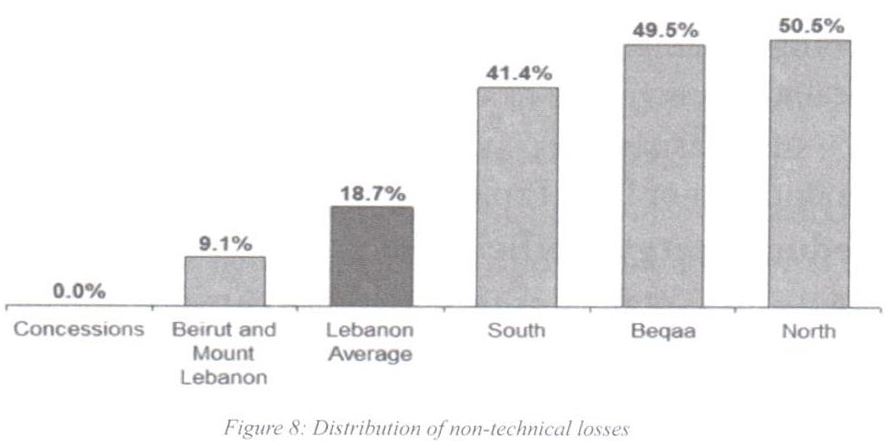

The rate of non-technical wastes are not the same, as it varies from one region to another, for instance the theft of electric power in the capital is around 9%, while it ranges between 40% and 50% in other provinces (see figure 8 below).[16]

Similarly, the rates of bills collection are different among regions[17]. It varies from 62% and 97%.

4- Administrative situation:

Regarding the human resources aspect, EDL has 1125 public servants (this number is decreasing due to annual retirement, while the actual number of employees required to fulfill the institution's organizational chart is 5027. In addition to 2000 daily contractual labors known as GAT workers (employed by politicians without any professional standards).

Moreover, EDL suffers from high political interferences and high bureaucratic regulations, which make the management system almost inefficient.

III- DSP Project Analysis

1- Reasons behind implementing DSP project

As described in chapter 2, the lebanese power sector suffers from complicated problems on all financial, administrative and technical levels.

EDL summarizes its short-term needs, before the implementation of DSP Project, as follows:

a- Reduce energy inefficiency:

Energy waste is defined as the difference between the financial value of the generated power and the collected financial value of this power. Consequently, energy waste includes the technical & non technical losses.

The energy waste in Lebanon varies from 60% (between 1994 & 1996) to 35% (between 2003 & 2005).

These losses constitute a real challenge to the financial situation of EDL & the lebanese treasury as well.

The technical losses were almost fixed during the period from 2002 to 2007 (15 %), while the non-technical losses, which include energy theft & uncollected bills, decreased in that period to reach 18% in 2007 (see figure 9 below)[18].

EDL has to resolve these serious losses resulted from technical and non-technical wastes, for the purpose of increasing the revenues and improving the financial standing of the institution, in order to allow more investments in energy production.

b- Construction of distribution facilities:

Since the distribution network is aging and overloaded, EDL needs to provide new connections and install additional indoor and outdoor substations and transformers. This action will help to reduce technical waste and increase energy efficiency.

c- Improve bill collection:

The rate of uncollected bills in EDL is roughly 20%. However, if such rate could be decreased, it can reduce non technical waste and increase revenues as well as mitigating the financial gap.

Accordingly, EDL expects from DSP Project to improve the distribution services and balance gradually the power supply and bills collection among provinces.

2- Objectives of the DSP Project

DSP project is a contractual PPP that aims to operate and maintain the distribution department at EDL, in addition to other tasks specified in the contract documents. This project was adopted to improve energy distribution service in Lebanon. It aims to reform and operate some EDL functions according to a contractual partnership that includes mobilization, network survey, plans & programs, installation of distribution technical requirements, network operation & maintenance, smart grid, bill collection and optimizing customer service.

DSP Project seeks for three qualified economic operators that have high financial and technical capacity in order to make the necessary investments for the purpose of upgrading the distribution network to deliver better customer service.

The promotion of the project stated that it will reduce the technical and non-technical waste from 40% to 12% over four years. Also, it will increase the value of fixed assets by 682 million USD[19] without any cost to the institution. Moreover, it is expected that the revenues of the project will cover its costs after two years from the commencment.

With reference to the consultant’s description, service providers have to plan, design, construct the distribution facilities, operate & maintain and implement smart. Mrid moreover they have to provide bill collection, meter reading and customer services.

On the other hand, the economic operator shall ensure a smooth transition by performing the adequate mobilization and conducting a network infrastructure survey, as he has to make all the necessary investments and plans associated with network development, in addition to other duties as follows:

Asset Management Activities, construction of distribution facilities (extension and re-enforcement), operation and maintenance, execution of smart grid (developed metering measurement), meter control, collecting bills, customer services and reporting to the owner (EDL).

|

Main Tracks |

Project Activities |

|---|---|

|

Preparation and Survey |

Mobilization Activities |

|

Network Survey Activities |

|

|

Planning and Expansion |

Plans and Programs |

|

Asset Management Activities |

|

|

Construction & Implementation Tasks |

Construction of Distribution Facilities |

|

Operation and Maintenance |

|

|

AMI Activities |

|

|

Customer Service and Bill Collection |

Meter Reading Activities |

|

Bill Collection Activities |

|

|

Customer Services Activities |

|

|

Coordination & Management |

Management and Reporting Activities |

3- The scope of work is presented as follows[20]:

a- Prepare services related to Project Mobilization in terms of vehicles, equipment, and personnel within the first two months of the contract.

b- Complete a comprehensive Network Survey to assess the condition of all assets, develop network mapping of such assets. This shall be conducted within the first six months of the contract.

c- Develop all Plans and Programs for each of the activities to be performed by the Service Provider in executing this contract. These Plans and Programs shall be delivered within the first six months of the contract.

d- Services related to the Construction of Distribution Facilities in correlation with network extension and re-enforcement that will be conducted throughout the contract period:

• Ensure new subscriptions to the clients;

• Installation and commissioning of indoor and outdoor Substations (MV, MV/LV): installation of panels, installation of transformers (pole mounted and ground mounted), installation of distribution boards, etc...

• Installation and commissioning of OHL including poles (MV and LV steel, concrete, and wooden poles): excavation, installation, painting of steel poles, cutting of wooden poles, etc...

• Cable laying and OHL (MV and LV): civil works, cable laying, termination and joints, installation of Overhead Lines, etc...

• Maintaining a record of all activities and works performed.

e- Services related to the Distribution Network Operation and Maintenance that will be conducted throughout the contract period:

• Operations Services

• Maintenance Services

• Repair Services

• Management and Coordination Services

f- Services referred to the execution of Advanced Metering devices (responsible for purchasing & installing) that will be conducted throughout the contract period:

• Advanced meters with all necessary accessories at customers.

• Advanced meters with all necessary accessories at MV feeders.

• Advanced meters with all necessary accessories at MV/LV transformers.

g- Services related to Meter Reading activities that will be conducted throughout the contract period:

• Undertake the role of reading customer’s meter.

• Control the current existing meters in addition to the new smart meters that will be installed according to the project’s scope.

• Develop a procedure for the detection of infringements.

• Keep the data of meter records.

h- Services related to Customer Services that will be conducted throughout the contract period:

• Address and resolve the complaints originated by the customers.

• Take over the responsibility of customer requests associated with operation process of distribution service.

• Inform the responsible parties to dispatch the technical teams in order to perform the necessary fault isolation and power restoration.

i- Services related to Bill Collection Activities that will be conducted throughout the contract period:

• Manage the whole process of collecting the bills which are issued by EDL.

• Service provider shall transfer the value of collected bills to the financial account of EDL.

• Organize and prepare the relevant figures associated with the process of bill collection and service quality in order to support the management of EDL about the progress of work.

• Provide and maintain detailed records of customer bill collection and accounts receivable.

• Discover the illegal connections in favor of increasing collection rate;

• Adopt a meter reading scheme that would improve the collection process as well as the collection rate.

• Identify and record all outstanding accounts and take all necessary measures to collect outstanding accounts.

• Report all non-paying customers, disconnect and re-connect activities.

3- Tender preparation

a- Procurement procedure:

The procurement procedure conducted was a restricted tender (two stages including prequalification) because DSP contract is deemed complex, as it involves procuring goods, service and works.

The aim of conducting this method is to achieve the main goal of effective procurement which is maximizing the “value for money” without neglecting the importance of technical aspects in such complex projects.

Moreover, the performance level of economic operators will be measured by using key performance indexes in order to evaluate the service quality.

• Contract duration: the economic operator shall execute the requested services over 48 months subject to extension depending on the performance of the Service Provider, upon agreement by both parties. In the case of extension, the Service Provider prices will be revised subject to Owner / Program Manager Approval.

b- Awarding criteria:

Since the contract is considered complex and needs high qualified economic operators, the award criteria is MEAT.

• Scoring formula: subject to ITB Instructions to Bidders, the public authority will award the contract to the private party, whose technical and financial evaluation can get a highest score depending on the following equation:

Total score = { (TTS / TTmx) * 0.30 } + { TFTMk * 0.70 }

Abbreviations:

TTS: Technical Tender submitted.

TTmx: The maximum technical marking of all Tenders submitted.

TFTMk = (Minimum of all Financial Tender) / (Financial Tender)k.

c- General conditions

Payment mechanism: the following instructions reveal how the mechanism of payment would be during the contract implementation:

1. The Service Provider is entitled to invoice his activities and services on a quarterly basis throughout the project. The eligible Performance Compensation Payment I (PCPI) and Payment III, to be paid to the Service Provider.

2. The economic operator is entitled to invoice his activities and services on a quarterly basis throughout the project. The eligible Performance Compensation Payment II (PCPII) will be paid to the Service Provider with no adjustment.

3. The economic operator shall deliver an invoice before 15 days after the completion of 30 days period to which the invoice applies. If the End Date falls on a date that makes the Service Provider’s last period of operation less than 30 days, the Service Provider shall submit an invoice that pro-rates the Monthly Payment based on the number of days that the Services and Activities were provided in the final period of operations.

4- Implementation of DSP Project:

After two years of contract beginning, the following observations were reported by the project management committee and supported by the control management in “Eléctricité du Liban”:

a- Project Mobilization: Mobilization activities were supposed to be delivered after two months from contract commencement, but economic operators haven’t performed it yet despite several postponements.

b- Network Survey: It was supposed to be performed after 6 months from contract commencement, but the economic operators haven’t accomplished it yet, because they didn’t make the necessary investments. Moreover, they don’t have the technical capabilities to do such work.

c- Plans & Programs: economic operators exceeded the time limit stated in the contract to perform the plans & programs. This shows that these economic operators are not performing seriously.

d- Construction of Distribution Facilities: the status was not improved regarding this mission, and the investments were still not enough comparing to the expected one at the beginning of the project.

e- Distribution Network Operation and Maintenance: this service is relatively improved, especially after ensuring new equipments specialized for detecting defects of underground power cables. However, it didn’t reach the desired level as indicated by KPIs . The economic operators, in that sense, shouldn’t only repair the damage, but they should also do all the necessary actions in order to avoid such damage in the next time.

f- Advanced Meter Infrastructure: the core of this mission is to substitute all customer meters by smart meters in order to proceed with the new network, while actually nothing is made in that sense, as service providers.

g- Bill Collection Activities: economic operators conducted the same methods that were followed previously by EDL but with less efficiency, as they failed to introduce an action plan to achieve the objectives of DSP Project which aimed to increase the financial revenues.

In this regard, the following observations have been noticed recently:

- There is no increase in the collection rates as expected;

- The number of errors of meter reading remains high;

- Delays in the delivery process of bill collection, especially the one that is related to medium voltage;

- Delays in the process of disconnecting the power supply when the customers don’t pay their bills;

h- Customer services: it didn’t reach to the required level as stated in the terms of reference (TOR), since service providers were still using the traditional procedures that were followed by EDL before DSP Project. On the other hand, service providers were didn't provide the project management committee with the administrative data necessary for key performance indicators.

Conclusion & Recommendations

DSP Project is mainly a service contract that aims to optimize customer service and maximize the revenues of EDL through reducing the technical and non technical losses. Also, it aims to carry out investments of distribution network, including the installation of the smart grid that will enable a full control on the power distribution which will lead to energy efficiency.

However, DSP Project encountered numerous obstacles due to the following reasons:

1- Project Consultancy:

Since consultancy services are deemed critical, the procurement method conducted to hire the consultant was a direct method which means there is no competition.

2- Inefficient economic operators:

The limited technical and financial capacity of economic operators didn’t fit the contract requirements. Moreover, they don’t have utility experience or background.

3- Tender preparation:

Some clauses in the tender documents were not clear and accurate, as it led to several conflicts between EDL and service providers in the implementation phase. The following observations are examples:

• Ignoring of some substantial issues that affect the project progress (e.g. transition of GAT …).

• Non clear business process and ambiguity of roles and responsibilities between public institution and private companies which affects the performance of the latter as well as KPIs;

• The possibility of different interpretations for some concepts and procedures.

• The payment scheme is very stringent and risky;

• Conflict among Contract parties in interpreting the Conditions of Contract.

4- Political issues:

The continuous strike of GAT (Ghob Al Talab - daily based workers) creates unstable environment in the EDL.

5- Change management:

Lack of smooth administrative transition of the distribution sector as no preparations or plans were made in that regard. Moreover, the public servants didn't accept the rapid change as they were not involved in the transition process. However, they suddenly found themselves out of the business operation with limited authority.

Recommendations

• Based on the previous observations, it becomes obvious that DSP Project is going to fail and will not achieve the declared objectives because economic operators didn’t prove their seriousness and efficiency, and on the other hand, they don’t have the financial capacity to invest in such project.

• From my perspective, it is recommend to terminate the contract as soon as possible and apply all relevant damages, penalties and securities drafted in the contract to mitigate the disastrous consequences that may arise in case of continuing.

• Furthermore, DSP Project is still not a radical solution to the dilemma of power in Lebanon, because it treats only one part of the body (distribution part).

To rescue the power sector in Lebanon, we need an integrated project that consider not only power distribution but also power generation and power transmission, in order to reach the balance between demand and supply at all times and at a reasonable total cost.

References

1- Abdelnour, Ziad (August – September 2003), "The Corruption behind Lebanon's Electricity Crisis", Middle East Intelligence Bulletin.

2- Armstrong, Jim and Donald G. Lenihan (January 1999), "From Controlling to Collaborating: When Governments Want to be Partner", Institute of Public Administration of Canada, New Directions Number 3.

3- Abousleiman, Randa (2010), "Private Public Partnerships: Legal Considerations", Beirut, Abousleiman & Partners Law Offices.

4- Akintoye, Akintola, Matthias Beck, and Cliff Hardcastle (2003), "Public Private Partnerships: Managing Risks and Opportunities", Oxford, Blackwell Publishing Company.

5- Bult – Spiering, Mirjam, and Geert Dewulf (2006), "Strategic Issues in Public Private Partnerships: An International Perspective", Oxford, Blackwell Publishing.

6- EDL, Energy Management, Transmission Dept., "Financial and Engineering Support Services to EDL", Base Year Data Report.

7- EDL, Report issued by the Board of Directors of EDL about DSL Project (6/8/2013).

8- EDL, "Sustainable Development Department", Report No. 41421-LB, page 25 (2009).

9- E. R. Yescombe (2011), Public-Private Partnerships: Principles of Policy and Finance, Oxford, Butterworth-Heinemann.

10- Ghobadian Abby, David Gallear, Nicholas O'Regan, and Howard Viney (2004), "Public Private Partnerships: Policy and Experience", New York, Palgrave Macmillan.

11- Jamali, Dima (2004), "Success and Failure Machanisms of Public Private Partnerships (PPPs) in Developing Countries: Insights from the Lebanese Context", The International Journal of Public Sector Management, p 414 – 430.

12- Kernaghan, K.. (1993), "Partnerships and Public Administration: Conceptual and Practical Considerations", Canadian Public Administration 36 (1).

13- Ministry of Energy and Water (June 2010), "Policy Paper for the Electricity Sector".

14- The World Bank (Survey Results 2006), "Understanding Energy Use in the Industrial Sector of Lebanon", A Preliminary Analysis of the ALI/LCEC.

15- The World Bank (2007) “Public Private Partnership Units: Lessons for their designs and use in infrastructure”.

16- The World Bank (December 2009), "Energy Efficiency Study in Lebanon", Final Report.

Internet sources

1- Asian Development Bank, "Public Private Partnership Handbook",

http://www.apec.org.au/docs/adb%20public%20private%20partnership%20handbook.pdf (Accessed July 26, 2016).

2- ALAKHBAR News Paper,

http://english.al-akhbar.com/node/7234 (Accessed March 8, 2017).

3- ALMONITOR Web Page,

http://www.al-monitor.com/pulse/originals/2015/01/lebanon-electricity-supply-debt-disaster.html (Accessed March 8, 2017).

4- Bayoumy, Yara (October 20, 2010), "Lebanon Needs $20 billion for Infrastructure", Reuters,

http://www.reuters.com/article/us-mideast-summit-lebanon-infrastructure-idUSTRE69J3MB20101020 (Accessed October 20, 2016).

5- Economist Intelligence Unit, and Andersen Consulting (1999), "VISION 2010: Forging Tomorrow's Public Private Partnerships (Sample)", Economic Intelligence Unit Store,

http://store.eiu.com/product/1793437379-sample.html (Accessed November 14, 2016).

6- "Hayek Clarifies Concepts Related to Public Private Partnership" (April 22, 2010), The Daily Star,

http://www.dailystar.com.lb/article.asp?edition_id=1&categ_id=3&article_id=114049 (Accessed August 12, 2016).

7- Kisirwani, Maroun, "The Rehabilitation and Reconstruction of Lebanon", American University of Beirut,

http://ddc.aub.edu.lb/projects/pspa/kisirwani.html (Accessed October 25, 2016).

8- Sassine, George, "A New Vision for Lebanon",

www.georgessassine.com (Accessed, June 12, 2016).

9- The Canadian Council for Public Private Partnerships, "Best Practices Guidelines",

https://www.pppcouncil.ca/ (Accessed July 27, 2016).

[1]- www.worldbank.org.

[2]- www.georgessassine.com, A New Vision for Lebanon.

[3]- http://ppp.worldbank.org/public-private-partnership/overview/what-are-public-private-partnerships.

[4]- Public-Private Partnerships: Principles of Policy and Finance, by E.R. Yescombe.

[5]- The Canadian Council for PPP.

[6]- http://www.apec.org.au/docs/adb%20public%20private%20partnership%20handbook.pdf (Asian Development Bank – Public Private Partnership Handbook).

[7]- Understanding Energy Use in the Industrial Sector of Lebanon, Survey 2006, ALI/LCEC Report.

[8]- Despite the decline in oil prices during the last two years, but it is expected that oil prices will bounce back.

[9]- GWH: Gega Watt Hour

[10]- USC: United States Cent

[11]- http://www.almee.org/pdf/L'ENERGIE%20AU%20LIBAN%202006.pdf

[12]- EDL, Energy EDL, Base Year Data Report, p. 75.

[13]- World Bank, Energy efficiency study in Lebanon – Dec 2009.

[14]- World Bank, Energy efficiency study in Lebanon- Dec 2009.

[15]- According to ALAKHBAR Newspaper (http://english.al-akhbar.com/node/7234): "The government-controlled electric company continues to be a burden on Lebanese taxpayers despite its monopolistic status. Unpaid bills are one reason for its heavy financial losses, and many of those are owed by leading politicians. Energy Minister Gebran Bassil continues to correspond with the Lebanese electricity company (EDL) concerning outstanding payment on the bills of politicians and other personalities. On 23 April 2010, the minister sent a letter (#907/O) to EDL’s general director. It requested that the director inform former and current officials and some personalities and institutions about the need to pay outstanding bills one month after receiving the request".

[16]- World Bank, Energy efficiency study in Lebanon- Dec 2009.

[17]- According to ALMONITOR Web Page (http://www.al-monitor.com/pulse/originals/2015/01/lebanon-electricity-supply-debt-disaster.html): "There are the issues of administrative corruption including the EDL’s failure to collect owed bills from subscribers, in light of the security conditions in some areas in the Bekaa Valley, in northern Lebanon and in the Palestinian refugee camps. According to the study, the cumulative total of EDL’s uncollected bills amounted to nearly $1 billion by the end of 2014. A quarter of these bills are owed by the Palestinian refugee camps in Lebanon, whose sum has risen in the last three years by more than a third. This overall figure is expected to rise in the coming years, given the presence of more than 1 million Syrian refugees in Lebanon, some of whom are illegally consuming electricity.

[18]- World Bank, Energy efficiency study in Lebanon- Dec 2009.

[19]- Declared in feasibility study made by the project’s consultant.

[20]- Appendix 3A “scope of services” .

"مزوّد خدمات التوزيع" في مؤسسة كهرباء لبنان

تهدف هذه الدراسة إلى تقويم حالة قطاع الطاقة في لبنان بعد بدء العمل بمشروع "مزوّد خدمات التوزيع" في مؤسسة كهرباء لبنان، وذلك بهدف إستخلاص الدروس للمستقبل من خلال الإجابة عن ثلاثة أسئلة مهمة:

1- ما هي أسباب إعتماد مشروع "مزود خدمات التوزيع"؟

2- ما هي الأسباب الرئيسة التي أدّت إلى فشل مشروع "مزوّد خدمات التوزيع"؟

3- كيف يمكن التعامل مع الوضع الحالي في ضوء النتائج السلبية الناجمة عن مشروع "مزود خدمات التوزيع"؟

فعلى الرغم من أنّ مشروع "مزوّد خدمات التوزيع" هو في الأساس عقد خدمة يهدف إلى خدمة العملاء بشكل أفضل من جهة وتعظيم إيرادات مؤسسة كهرباء لبنان من جهة أخرى، وذلك من خلال الحد من الخسائر الفنية وغير الفنية، إضافةً إلى تنفيذ إستثمارات في شبكة التوزيع بما في ذلك تركيب الشبكة الذكية التي سوف تسمح بالسيطرة الكاملة على توزيع الطاقة في لبنان، إلّا أنّ النتائج جاءت غير مرضية. فلقد واجه المشروع عقبات عديدة ناتجة عن أسباب مختلفة كعدم كفاءة المشغلين، القضايا السياسية، تحضير المناقصة، الخدمات الإستشارية إضافةً إلى إدارة التغيير.

وقد تمّ تقسيم هذه الدراسة إلى ثلاثة فصول:الفصل الأوّل، تناول الشراكة بين القطاعين العام والخاص، والفصل الثاني تناول وضعية مؤسسة كهرباء لبنان، في حين أنّ الفصل الثالث تناول تحليل مشروع "مزوّد خدمات التوزيع".

وأخيرًا، بعض التوصيات من وجهة نظر الباحث الذي يرى أنّ مشروع "مزوّد خدمات الطاقة" لن يؤدي إلى تحقيق الأهداف المعلنة، لذلك لابد من إنهاء العقد في أقرب وقت ممكن بهدف الحد من النتائج الكارثية التي قد تنشأ في حال الإستمرار؛ فمشروع "مزوّد خدمات التوزيع" ليس حلًا جذريًا لمعضلة الكهرباء في لبنان لأنّه يعالج موضوع توزيع الطاقة فقط، في حين أنّ المعالجة تحتاج إلى مشروع متكامل يتناول إضافة إلى توزيع الطاقة كل من توليد الطاقة ونقل الطاقة، وصولًا إلى تحقيق التوازن بين العرض والطلب في جميع الأوقات وبتكلفة إجمالية معقولة.