- En

- Fr

- عربي

Financial and economic prospects of Lebanese oil wealth

Abstract

Most developing countries consider oil wealth as a lifeline from poverty and a solution to their financial and economic problems. However, the experiences of many of these countries led to disappointing results. This research comes within the framework of an attempt to answer the availability of wealth dilemma and the persistence of financial and economic failures, significantly the budget deficit persistence. So, the research tended to prove the resources' presence first and then apply an empirical study of the effects of expected financial revenues on macroeconomic indicators to verify whether the oil wealth is a solution to Lebanon's financial and economic problems. The importance of this study lies in its assessment of the dilemma of the availability of petroleum wealth and the continuation of the financial and economic crisis, especially the budget deficit/surplus. It is highlighted in its attempt to predict the role of expected oil and gas revenues in stopping the Lebanese budget deficit and the extent of their contribution to resolving its crisis. This paper concluded that the budget deficit will renew regardless of the expected oil and gas revenues and their positive impact on the gross domestic product and economic growth rates. This was supported by the theoretical analysis and empirical study, which yielded the same results. However, the theoretical analysis was based on the government's behavior in managing public finance and dealing with economic issues.

Keywords:

Lebanon, economy, wealth, oil wealth, hydrocarbon resources, oil, gas and Dutch disease.

Introduction

Oil and gas resources play a crucial role at the economic level as one of the primary energy sources and continue to sit at the top of the energy mix worldwide. Hydrocarbon resources are expected to continue to play a fundamental function in the relationship between oil-producing and oil-consuming countries. That pushed Lebanon to explore oil and gas offshore after trying onshore.

Lebanon's attempts to explore oil went back to the 1940s and still ran until the end of the 1960s, with several wells drilled in different areas of the Lebanese mainland without reaching tangible results. Exploration attempts were renewed in 1993 with seismic surveys by the French company Geco-Parkla. In 2014, Neos GeoSolutions conducted aerial geological surveys that included part of the Lebanese mainland (LPA, 2024).

The Lebanese exploration efforts coincided with the results of US Geological Survey surveys in 2010, confirmed again in 2021, regarding promising oil and gas reserves in the eastern Mediterranean Sea basin. These reserves range between 1.4 and 3.7 billion barrels of oil, while gas ranges between 138.3 and 494.1 trillion cubic feet (USGS, 2022).

On the other hand, the hopes of the Lebanese were strengthened with the discoveries and extraction of hydrocarbon resources in the eastern Mediterranean Sea basin. They look forward to the availability of oil and gas reserves under Lebanese waters and their contribution to resolving the economic and financial crisis that Lebanon suffers.

This fact raises the question about the extent to which the expected revenues from Lebanon’s oil and gas reserves will contribute to resolving its financial and economic crisis. However, the availability of hydrocarbon resources in many countries did not prevent them from floundering in their economic problems and from their growth faltering, suffering from the curse of oil or Dutch disease. In contrast, from a theoretical point of view, the scarcity of resources is the cause of the economic problem.

Few Lebanese research addressed this topic, “The Economic Impacts of Oil and Gas Resources in Lebanon” being one of them. This research was limited to calculating the expected revenues from oil and gas reserves to conclude the years needed to pay off the public debt without studying the relevant macroeconomic indicators (Hamdar, Hejase, Akar, & Hassouna, 2016).

Hanadi TAHER wrote another research titled “The Lebanese Pre-salt Oil and Gas Production Economic Challenges and Revenues." This research discussed the challenges facing Lebanon's oil wealth and the inflationary implications of its revenues for the national economy. She proposed three future scenarios for oil and gas production extending over 20 years to calculate the expected revenues and their impact on national income (Taher, 2017).

Taher’s research used the Monte Carlo Simulation model, the challenges facing Lebanon's oil wealth, the multipliers of its inflationary revenues on the national economy, and the sensitivity of oil and gas production to price changes and its impact on financial revenues.

Therefore, this research attempts to find whether the expected revenues from oil and gas can cure the general budget deficit and contribute to resolving the Lebanese financial and economic crisis. Especially since neither study answered the extent to which these revenues contribute to solving Lebanon’s financial and economic crisis.

The contribution of oil and gas revenues in the solution of Lebanese crises demands the accomplishment of three hypotheses:

- The first: Lebanon has commercial reserves of hydrocarbon resources, making it an oil and gas-producing country.

- The second: The size of the expected revenues from investing reserves depends on the production pattern at the prevailing price rate and the size of these reserves.

- The third: Positive relationship exists between expected revenues from oil and gas and the general budget deficit/surplus.

Theoretical analysis of the petroleum wealth availability dilemma and the continuation of the financial and economic crisis demands verification. This verification requires an empirical study of macroeconomic indicators and the impact of expected financial revenues, especially on budget deficit or surplus.

Discussing the topic and its hypotheses, understanding them, analyzing their impact, and obtaining scientific results requires the application of many research methods. These methods range from quantitative to qualitative and then to empirical.

The advantages of both approaches, based on the principle of complementarity and comprehensiveness between the two methods in a way that meets the requirements of integrated scientific.

Research Methods

Exploring the financial and economic prospects of Lebanon's oil wealth requires identifying the situation of its resources and calculating its expected revenues. This goal necessitates adopting mixed research methods: the qualitative method allows for collecting information on oil wealth reserves, and the quantitative approach tolerates estimating Lebanon's expected oil and gas reserves and revenues (Gray, 2014).

At the same time, triangulation of research results was adopted to validate the research findings further and rectify the gap between the adopted research methods (Creswel, 2003).

On the other hand, the primary research method was to collect data on oil and gas reserves, calculate their expected revenues, and then study their role in resolving the Lebanese crisis.

The qualitative method used in this research presents the path of Lebanon's interest in oil resources from the 1940s until today. This approach covers all information on hydrocarbon resources and their industry and presents opportunities and challenges. Data related to hydrocarbon industry was derived from international reports, such as reports from international organizations and concerned local authorities.

Qualitative data is supported and expanded by quantitative data to deepen its description effectively. The quantitative method applied in this research calculates resources and their expected revenues. As part of the quantitative method, the empirical approach estimates the expected role of oil and gas revenues in reducing the budget deficit and resolving Lebanon's financial and economic crisis.

The triangulation design is one of the most common mixed methods designs, in which the research implements both quantitative and qualitative methods within the same time frame. This design helps the researcher understand the research problem better by collecting and analyzing quantitative and qualitative data simultaneously but separately.

The empirical study

The empirical study applied in this research is multiple linear regression. Using a straight line, this regression model estimates the relationship between a quantitative dependent variable and two or more independent variables. The multiple linear regression model can be used to find out:

• How strong is the relationship between two or more independent variables and one dependent variable?

• The value of the dependent variable at a particular value of the independent variables.

The model-dependent variable is the general budget deficit, reflecting the Lebanese financial and economic crisis.

The expected oil and gas revenues do not meet the model conditions to calculate their impact on the general budget surplus/deficit.

Meanwhile, according to model conditions, model-independent variables are GDP, growth rate, and interest rate.

Note that we cannot use expected oil and gas revenues in this model because there is no historical data.

Results

This section aims to present all the data that was gathered by using the previously discussed research methods.

The qualitative method allows for first getting the appropriate information on the presence of oil and gas and second expecting the amount of reserves.

In 2012, the British-based Norwegian company Spectrum estimated the available volume of natural gas reserves at about 25 trillion cubic feet (tcf), considering that the reserves available in that region are among the richest and best reserves in the eastern basin of the Mediterranean Sea (Mehdi Haroun, King & Spalding, 2018).

In 2013, the French company Beicip Franlab considered that the Lebanese northern coast has oil reserves ranging between 440 million and 675 million barrels, with an average equivalent of 557.5 million barrels and natural gas at 15 trillion cubic feet (Naharnet, 2013).

In September 2014, the Lebanese Petroleum Administration estimated the equivalent reserves of blocks 1, 4, and 9 (P50) at 43.2 trillion cubic feet of natural gas and 865 million barrels of oil (Joe Dyke, Jeremy Arbid, 2014).

In 2021, the US Geological Survey confirmed what it had previously announced in 2010 about the possibility of oil and gas reserves in promising quantities in the eastern basin of the Mediterranean Sea. These reserves range between 1.4 and 3.7 billion barrels of oil, while gas quantities range between 138.3 and 494.1 trillion cubic feet.

Reserves estimated and declared by the Lebanese Petroleum Administration will only be used to calculate oil and gas revenues, even if they do not cover all the exclusive economic zone. Note that the other expectations were mentioned above to support the Lebanese estimates.

Lebanon's extraction of oil and gas from its exclusive economic zone transforms Lebanon from an oil-consuming country into an oil-producing country. This allows Lebanon to use its natural gas products to operate its electrical power plants.

Expected revenues from oil and gas depend on the prices of these resources in global markets when extracted. These prices suffer from instability because they are linked to supply and demand in global markets, where they witness successive fluctuations.

The quantitative method helps calculate expected reserves and revenues and predicts the surplus/deficit value of the budget for the next fifteen years, which are the assumed years of production.

To obtain the expected oil and gas net revenues, only 35% of the expected price rate was used when calculating these revenues. This rate is the net percentage of revenues after deducting all costs and company profits.

The nominal price of Brent crude oil is expected to reach $66 per barrel in 2025 and $89 per barrel in 2030, and by 2040, it is expected to reach $132 (EIA, 2021).

The nominal price of one thousand cubic feet (or (MMBtu)) is expected to reach $3.10 in 2025 and $4.08 in 2030. By the year 2040, prices are expected to reach the level of $5.40 (EIA, 2021).

Production and revenue scenarios were proposed and calculated for fifteen years from 2026 until 2040, divided into three different scenarios:

• The first scenario is an annually equal scenario production and a fixed price.

• The second is an annually equal production scenario with an increasing price.

• The third scenario is during which production and prices increase year after year. Each impacts the expected revenues and the desired economic and financial solutions differently.

The oil and gas revenues estimated by the first scenario were $24.22 billion from gas and $56.44 billion from oil, which makes the total revenues $80.66 billion.

According to the second scenario, the expected revenues are equal to $29.12 billion from gas and $65.16 billion from oil, for a total of $94.28 billion.

Thus, the third scenario exceeds the first scenario (equal production and price) at $17 billion. While the expected revenues from the second scenario are more than $3 billion, prices rise as production quantities are equal.

The total expected revenues from the third scenario from oil are $30.34 billion, and from gas,

$67.36 billion, bringing the total revenues from oil and gas to $97.70 billion.

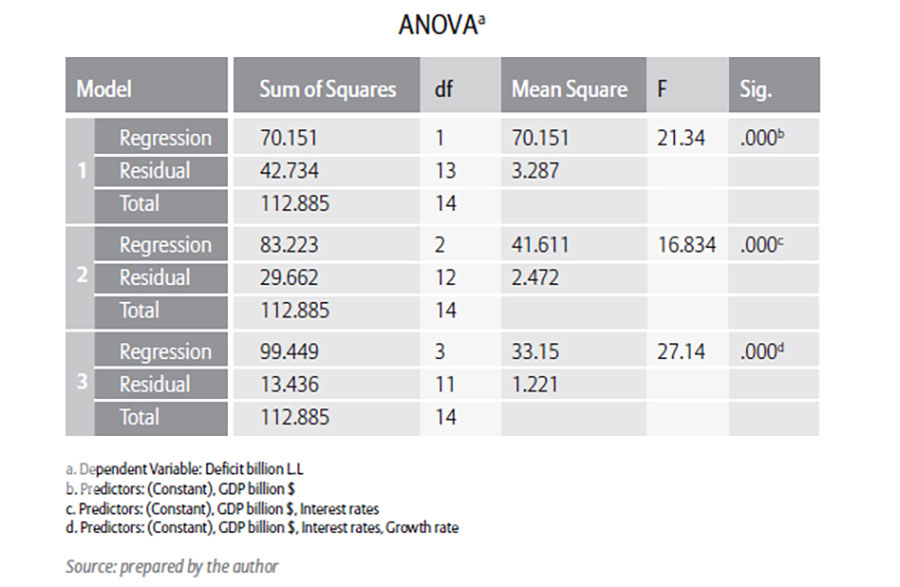

When applying the multiple linear regression model, it is essential to use some related statistics and test them to find whether they are helpful.

The multiple linear regression model allows the selection of independent variables and obtaining the value of the equation coefficients used in calculating the budget development during the period under investigation.

Three variables were added to the model, one variable at a time. Only statistically significant variables were added, and at each iteration, the model was assessed for any variable that could be excluded.

GDP is the first variable entering the model with R-squared = 0.621. The second model contains both GDP and Interest rate with R-squared = 0.737. The final model contains the variables in the second model with the growth rate.

The final R-squared = 0.881 which is a very good fit. This means that 88.1% of the variance in deficit is explained by the three variables together. All three variables in the final model are statistically significant.

The ANOVA table shows that at each iteration the model is statistically significant (p-value < 0.05).

From the Coefficients table we can build the equation for our final model, which is:

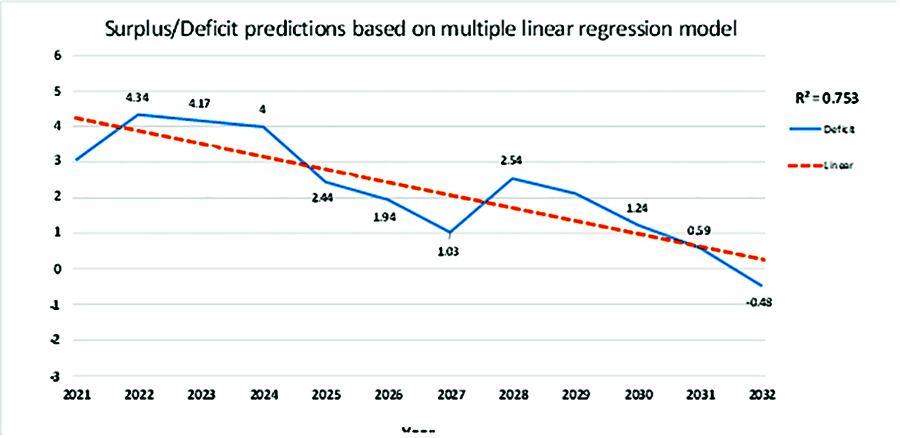

Budget Deficit/Surplus = 9.269 – (0. 168 * GDP) – (0.9 * Interest rate) + (0.125 * Growth rate)

GDP

At the end, the graph of the multiple linear regression model exhibit that after the public budget achieved a surplus, this surplus returned to decreasing and turned into a deficit again as of the second half of 2032.

Discussion

This section aims to discuss the research results and determine how its hypotheses fit with the expected oil and gas resources. This discussion is based on the available data on the size of oil wealth in the eastern basin of the Mediterranean Sea, which immensely helped estimate Lebanese reserves and expect their revenues.

Based on those findings, the Eastern Mediterranean Basin region ranks tenth on the list of regions most likely to find gas during the next thirty years, compared to 219 regions worldwide (Elias, 2016). This assessment makes the reserves announced by Spectrum, Bisseb Franlab, and the Lebanese Petroleum Administration rational.

These estimates are consistent with US Geological Survey assessments of oil and gas reserves in the Eastern Mediterranean Basin published in July 2021. Reserves were estimated at an average of 879 billion technically recoverable barrels of oil, while gas reserves amount to about 286.2 trillion cubic feet (USGS, 2022).

The Synthetic Aperture Radar (SAR) images helped increase the confidence in those estimates. The images revealed a leak of approximately 200 types of hydrocarbons in the northern part of the eastern basin of the Mediterranean Sea (Pajot, 2013). These results assume the presence of oil and gas under the Lebanese marine waters, like other geographical areas of the Mediterranean basin (Wissam Chbat, Wael Khatib & Jad Abi Khalil, 2019).

At the economic level, local oil and gas lead to producing electrical energy, eliminating the need for imports, and reducing their cost, which helps reduce the trade balance deficit. Natural gas can also replace fuel in the production of electrical energy.

In addition, companies producing oil and gas will pay royalties, fees, and taxes, which will improve government revenues. This will decrease the general budget deficit and finance infrastructure improvements, encouraging related industries.

The contribution of the above oil and gas revenues to the economy depends on the extent to which they are managed responsibly. The more these revenues are adequately used, the more they can contribute to economic growth, create jobs, promote sustainable development, and enhance development opportunities. Financial streams generated from these industries can also help alleviate capital scarcity and borrowing costs, thereby boosting investment, creating more job opportunities, and increasing consumption.

However, hydrocarbon resources are non-renewable and unsustainable, and their revenues are unstable. These revenues are usually accompanied by inflationary complications caused by the improvement in the price of the national currency and the resulting decline in the competitiveness of productive economic activities. This complication is known as Dutch disease because it suffers from its complications.

Besides, oil and gas revenues usually encourage governments to expand useless public spending, waste public money, and spread corruption, which leads to more pressure on the national economy.

Production and revenue scenarios had to be adopted to estimate expected revenues and show the extent of their contribution to the GDP. Although revenues were lower than anticipated, mere GDP growth should stimulate the development of economic sectors and encourage more new investments.

The expected revenues, according to the third scenario, will not exceed the amount the government has already wasted in a few years and caused the financial and economic crisis. In contrast, it takes about fifteen years to get the expected revenues.

Furthermore, the empirical study, based on a simulation of the historical data of the three independent variables and the surplus/deficit calculation, shows that the public budget deficit will be renewed even though the GDP continues to rise.

Ultimately, it is too early for Lebanon to bet on revenues that have not yet been verified. Efforts to explore its sources and produce them face difficulties and obstacles. Not only is the matter not limited to the technical aspect, but it also includes internal complications between political parties conflicting over everything, including expected revenues.

Conclusion

Based on the theoretical analysis and the result of the empirical study, the expected oil and gas revenues will be insufficient to constitute a sustainable solution to the economic and financial crisis, regardless of the size of these revenues. The government's way of spending available revenues will ensure that the fate of the expected oil and gas revenues will not differ from Lebanese general budget revenues. Public expenditure will, therefore, exceed these revenues, exacerbating the budget deficit and underscoring government mismanagement.

This research concludes by emphasizing that resolving the crisis requires more than just cash flows; It requires implementing good governance, structural reforms and reducing rampant corruption in state administrations. In other words, establishing the rule of law and implementing accountability and responsibility.

This paper suggests that there is no solution to the Lebanese financial and economic crisis except by expanding the economy and stimulating economic growth. Especially since the expected revenues mentioned above are less than those that the Lebanese government wasted from foreign currency reserves.

With the aspiration for oil and gas extraction to become a reality, resolving the banking sector crisis constitutes one of the main gateways to resolving Lebanon's financial and economic crisis. Chiefly, there is no way to conduct an efficient economy without the role of the banking sector and payment tools.

Bibliography

1. LPA, L. P. (2024). Lebanese Petroleum Administration. Retrieved from https://www.lpa.gov.lb: https://www.lpa.gov.lb/english/resource--center/timeline/2d-seismic-survey-acquired-by-geco-prakla

2. Taher, H. (2017). The Lebanese Pre-salt Oil and Gas Production Economic Challenges and Revenues". International Journal of Energy Economics and Policy, 7(3), 300-307.

3. Gray, D. E. (2014). Doing Research in the Real World. London: Sage Publications Ltd. Creswel, J. W. (2003). Research Design Qualitative, Quantitative, and Mixed Methods Approaches. London: Sage Publications.

4. Mehdi Haroun, King & Spalding. (2018, October). https://www.jdsupra.com/legalnews/.

5. Retrieved from https://www.jdsupra.com/legalnews/lebanon-s-first-steps-in-the-oil-and-66301/

6. Naharnet, N. (2013, February 13). Nahar Net. Retrieved from https://www.naharnet.com/: https://www.naharnet.com/stories/en/71691

7. Joe Dyke, Jeremy Arbid. (2014, October). Lebanon's Oil And Gas. Executive.

8. Elias, A. R. (2016). https://www.researchgate.net/publication/299960181_Petroleum_ Resources_ in_the_Lebanese_Offshore_The_Need_for_Credible_Assessments_and_ Adequate_Policy.

Retrieved from Researchgate.net/publication/: https://www.researchgate.net/publication/299960181_Petroleum_Resources_in_the_L ebanese_Offshore_The_Need_for_Credible_Assessments_and_Adequate_Policy

9. Pajot, E. (2013, June). researchgate.net/publication/. Retrieved from Researchgate net: https://www.researchgate.net/publication/266634236_Examples_of_SAR_Imagery_App lications_to_the_Petroleum_Industry

10. Wissam Chbat, Wael Khatib & Jad Abi Khalil. (2019, December 1). https://geoexpro.com/.

Retrieved from GeoPro: https://geoexpro.com/will-lebanon-be-the-next-hydrocarbon-exploration-hotspot/

11. Hamdar, B., Hejase, H., Akar, W., & Hassouna, S. (2016). THE ECONOMIC IMPACTS OF THE OIL AND GAS RESOURCES IN LEBANON". International Journal of Economics, Commerce and Management., Vol. IV, Issue 7.

12. EIA, U. E. (2021). Retrieved from https://www.eia.gov/: https://www.eia.gov/outlooks/aeo/pdf/appa.pdf

23. USGS, U. S. (2022, July). Retrieved from https://pubs.usgs.gov/fs/2021/3032/fs20213032.pdf

الآفاق المالية والاقتصادية لثروة لبنان النفطية

العميد المتقاعد غازي محمود

تلعب موارد النفط والغاز دورًا محوريًا على المستوى الاقتصادي، بوصفها من المصادر الأساسية للطاقة، ولا تزال تحتل موقعًا متقدمًا في مزيج الطاقة العالمي. وتُعدّ الثروة النفطية بمثابة حبل نجاة للدول النامية، للخروج من دائرة الفقر وحلًا لمشكلاتها المالية والاقتصادية. غير أنّ تجارب العديد من هذه الدول أفضت إلى نتائج مخيّبة للآمال. في المقابل، من المتوقّع أن تبقى الموارد الهيدروكربونية عاملًا جوهريًا في تشكيل العلاقات بين الدول المنتجة للنفط والدول المستهلكة له.

وقد عزّز اكتشاف واستخراج الغاز والنفط في مياه الدول المجاورة للبنان والمطلة على حوض شرق البحر الأبيض المتوسط، آمال اللبنانيين الذين يترقّبون بشكل متزايد احتمال وجود احتياطات من النفط والغاز ضمن المياه الإقليمية اللبنانية، وما يمكن أن تساهم به في معالجة الأزمة الاقتصادية والمالية الحادّة التي يعاني منها لبنان. وذلك على الرغم من أن تجارب العديد من الدول، تُظهر أنّ توافر الموارد الهيدروكربونية فيها لم يكن حلًا للمشكلات البنيوية المستدامة ولم يحُل بالضرورة دون الركود الاقتصادي.

ويثير هذا الواقع تساؤلًا جوهريًا حول مدى قدرة الإيرادات المتوقّعة من موارد النفط والغاز اللبنانية على المساهمة في التخفيف من حدّة الأزمة المالية والاقتصادية. من هنا، هدفت هذه الدراسة إلى تقييم إشكالية توافر الثروة البترولية واستمرار الأزمة المالية والاقتصادية، وبوجه خاص مسألة العجز أو الفائض في الموازنة العامة. كما تسعى إلى استشراف الدور المحتمل لإيرادات النفط والغاز المتوقّعة في وقف العجز في الموازنة اللبنانية، وقياس مدى مساهمتها في معالجة أزماته المالية والاقتصادية. وقد خلصت إلى أنّ عجز الموازنة سيعاود الظهور بغضّ النظر عن الإيرادات المتوقّعة من النفط والغاز، على الرغم من أثرها الإيجابي في الناتج المحلي الإجمالي ومعدلات النمو الاقتصادي. وقد دعمت هذه النتيجة كلٌّ من المقاربة النظرية والدراسة التطبيقية، اللتين توصّلتا إلى النتائج ذاتها. غير أنّ التحليل النظري استند بصورة أساسية إلى سلوك الدولة في إدارة المالية العامة وتعاطيها مع القضايا الاقتصادية.

ما يجعل من المبكر جدًا أن يراهن لبنان على إيرادات لم يتم بعد التحقق من حصولها، وتعترض جهود التنقيب عن مصادرها (من نفط وغاز) والعمل على إنتاجها، عقبات لا تقتصر على الجانب التقني، بل تتخطاها إلى تعقيدات داخلية. كل ذلك يجعل من الوضع القائم ضبابيًا واتجاهاته غير محسومة، على الرغم من الجهود التي بُذلت حتى اليوم لجهة المسوحات والإطار القانوني والتنظيمي وإطلاق دورات التراخيص الأولى والثانية.