- En

- Fr

- عربي

The Impact of Oil and Natural Gas Discoveries on the Lebanese-Israeli Conflict

Introduction

The discovery of huge oil and gas fields in the Levant Basin could be a new prospect for bringing both wealth and economic development to each of the countries in the region. It could also improve the energy security for countries that have been importers for both oil and natural gas since their inception. With the amount of resources discovered, and depending on their agility and proper management of the new fortune, the Levant countries could join the club of hydrocarbon exporters.

This study seeks to address possible implications for two countries in this region, Lebanon and Israel, in light of the prospect of discoveries of oil and natural gas reserves offshore. It will review the question of the maritime borders and the controversial positions of the two countries and address the prospects of rising tensions between them on one hand, and the possible scenarios of cooperation on the other.

Implications for Lebanon

Lebanon has no oil or gas resources. While the country is located in the Middle East, an area historically rich in energy resources, no major oil or gas discoveries have ever been noted. Since its independence in 1943, the country started its search for oil by drilling many wells onshore. As the result was meager and once the civil war erupted in 1975, the government cancelled the exploration licenses.

This situation has changed with the discovery of significant natural gas reserves off the shores of Israel and Cyprus; the countries that share the same geological underwater basin with Lebanon. In August 2010, the Lebanese Parliament passed legislation concerning offshore Hydrocarbon exploration by allowing two Norwegian energy companies to conduct surveys in the Lebanese waters.([1]) The survey estimated that it holds 708 Billion Cubic Meters (BCM) of natural gas and from 440 to 675 million oil barrels.([2]) In 2013, The Lebanese cabinet adopted a decree specifying the conditions and qualifications for companies wishing to bid for an offshore exploration license. However, political turmoil delayed the deadline for submitting bids several times, putting the process of exploration in danger. Therefore, Lebanon is unable to start extracting oil and/or gas until at least around 2018, as planned. Meanwhile, huge new gas fields have been found offshore of Egypt and Israel, increasing the prospect that the pool extends into Lebanese waters as well.

Benefits and Challenges

In Lebanon, the potential benefits from a domestic supply of gas are immediately clear; ending power shortages, wiping out Lebanon’s rapidly rising public debt, reviving the economic sector, social development, and the reduction of pollution.

Locally produced natural gas is a major factor in resolving the question regarding the production of electricity in Lebanon. At present, the country suffers from daily cuts in electricity, because the demand exceeds 2,400 megawatts at peak times, while the production does not exceed 1,500 megawatts.([3]) Moreover, the production is costly, in that it relies on expensive, imported fuel, mainly diesel, which causes an annual deficit of 1.5 billion dollars on the public purse and generates losses on the national economy estimated at no less than $2.5 billion dollars per year. ([4]) Lastly, diesel generators used locally by citizens to provide for the missing electricity are not only a financial burden, but are also a source of air pollution. This dire situation could certainly be made better by using natural gas; allowing the country to switch its power plants from imported fuel to locally sourced natural gas.

Perhaps the Lebanese economic sector will benefit most from the exploitation of the new discoveries. The opportunities might contribute to an increase in sustained economic growth, increase Lebanon’s Gross Domestic Product (GDP) and possibly create more opportunities for investors and direct revenues through the collection of royalties and profits from oil and gas production([5]). Furthermore, oil and gas revenues might also help Lebanon better manage its public finances by reducing the government’s expenses, and thus reduce budget deficits; especially in light of the fact that the country is encumbered with one of the highest debt rates in the world (133.28 percent of GDP in 2014).([6]) Moreover, the development of gas fields might help reduce the deficit in the country’s current account balance by increasing exports and/or reducing imports of other fossil fuels. Lebanon recorded a Current Account deficit of 25 percent of the country's Gross Domestic Product (GDP), in 2015.([7]) In addition, these revenues will help the industrial sector to grow and change the current situation of the Lebanese economy which relies heavily on the service sector (76 percent of GDP), while the industrial sector only accounts for 19 percent of GDP.([8]) Lebanese industrialists might even benefit from a low cost energy bill by allowing their products to compete on the international markets.([9])

The discovery of gas and oil has the potential of contributing to Lebanese social development as well. It might create jobs, spread wealth, and reduce unemployment; which was estimated around 23 percent as early as 2015 and rises to 33 percent amongst the youth.([10]) In fact, the Lebanese government could encourage International Oil Companies (IOCs) to employ up to 80 percent of Lebanese nationals in their workforce. More importantly, the Lebanese Parliament would welcome the opportunity to promote social welfare, not only for the current generation, but for future generations too.([11]) The Offshore Petroleum Resources law enacted in August 2010, stipulates that “the net proceeds collected or received by a government arising out of Petroleum Activities or Petroleum Rights shall be placed in a sovereign fund.”([12])

Finally, by switching to gas-generated electricity, Lebanon might also be contributing to its environmental security. In fact, natural gas is the cleanest burning fossil fuel; generating lesser amounts of greenhouse gases and pollutants per unit of energy produced than do other fossil fuels. In addition, natural gas is proven to have an environmental advantage when compressed and when used in the transportation sector. Cars running on this type of fuel have fewer hydro-carbon emissions than any other vehicle fuel being used today.([13]) This could lower the emission of toxic gases in greater Beirut, where the high level of Nitrous Oxide goes beyond the international lower limit. ([14])

On the other hand, Lebanon faces a number of challenges that may negatively influence resource exploration and production activities and deter firms from exploring its resource. These challenges are mainly related to repercussions from Syria's war, political instability, corruption, technical problems and the maritime border disputes with Israel.

The conflict in Syria negatively affects Lebanon in many ways which do not reassure potential investors. The first is that the Syrian war is one of the key causes of the political impasse that the country is facing, such as the delay of the presidential election. ([15]) Secondly, Syria's conflict has generated gun battles, rocket attacks, car bombs and kidnappings inside Lebanon's borders.([16]) Thirdly, the afflux of one million Syrian refugees to a small country like Lebanon further confuses the situation; especially in light of the fact that many militants are mixed with civilians while they try to take advantage of destabilizing the security of the country ([17]).

The predominant political instability in the country could also affect foreign companies’ interests in getting involved in the exploitation of offshore resources. In fact, the delicate balance existing among the main communities constituting the Lebanese population hide underlying tensions between these communities of differing religious and political loyalties. This dynamic has resulted in repeated power vacuums that have characterized the country’s history and continue to manifest today.([18]) The Parliament has been unable to elect a new president since 25 May 2014. This situation makes it difficult to start the exploration program. The repeated postponements risk deterring oil and gas majors who would seek opportunities elsewhere.([19])

Another problem facing the new resource exploration is the high level of corruption within the country. According to Transparency International, Lebanon ranked 127th out of the 177 countries assessed, which placed it among countries that has higher rate in corruption for 2015.([20]) This could be an indicator that oil revenue would not be equally shared by all Lebanese ([21]).

Technical issues could also hinder gas exportation from Lebanon. At the moment, the war in Syria doesn’t allow any use of pipeline. Lebanon would have to export its gas by sea, in tankers, and Lebanon has no facilities to do so. Even if it did, it would have to compete in the world market with lower-cost suppliers in other countries.

Finally, the country has little experience in the petroleum sector. Very little oil and gas developments have occurred in Lebanon since as early as 1947. In addition, the only experience that Lebanon had in the petroleum sector was in refining. Lebanon was among the first in the Middle East to build oil refineries in the 1950s, but now its facilities in Zahrani and Tripoli are inoperative.([22])

Lebanon's strong points

It is true that Lebanon is lagging behind its neighbors in the region (Israel and Cyprus who are already either exploring for or exploiting their resources) with regard to exploration and production activities; however, the country may compensate for this through other possible strong points.

First of all, Lebanon’s strategic location and its good relation with its neighbors (except for Israel) provide added value for Lebanon compared to other countries in the region. ([23]) Located in the vicinity of Turkey, Europe and the Suez Canal, Lebanon benefits from relative ease of access for exporting Lebanese gas to the region when the war ends in Syria, to Europe through onshore or offshore pipelines, and to the international market through LNG plants that can be built in Lebanon, jointly with other countries in the region, or by using existing plants in Egypt for example.([24]) This may allow Lebanon the opportunity to play a role in supplying a portion of the regional demand, but more importantly, contribute to the diversification of gas supplies. Depending on the volume of gas that may be produced, Lebanon may be able to access the global market through LNG. ([25])

Offshore exploration requires capital to extract energy reserves as well as developing the needed infrastructure for gas processing and transportation. It is true that the Lebanese government lacks capital needed for exploration activities, however the Lebanese private sector in general, and the banking sector in particular, possesses the tools suitable for this kind of investment.([26])

In addition, Lebanon has a very prestigious education system which can generate a qualified workforce and human resources. According to a 2015 World Economic Forum report, Lebanon is ranked 10th in overall quality of education, and 4th in science and math.([27]) This indication might allow the country to have the skills needed to actively engage in developing the oil and natural gas sector, and also provide IOCs with less cheaper local employees, relieving them from bringing their own workforce particularly in cases of critical security status. ([28])

Finally, it is worth mentioning that the Lebanese government conducted extensive and high quality 2D and 3D seismic surveys covering 100 percent (2D) and 70 percent (3D) of the Lebanese offshore areas respectively. A tally of this seismic data offers a realistic idea of natural gas and oil resources that could be discovered under the waters of the Lebanese waters. This could reduce the exploration phase. ([29])

Implications for Israel

Since its founding in 1948, Israel has been almost totally dependent on fuel imports for energy. This expensive and risky process pushed Israel to search hard for energy resources. In the late 1950s, the first attempts to discover onshore petroleum began when small gas fields were discovered in the southern Judean Desert([30]). In 1969, offshore drilling started and the attempts lasted for 30 years without concrete success.([31]) These discoveries received a boost after the signing of the Camp David Agreement between Israel and Egypt in 1979. This new situation allowed IOCs to work in both countries.

Table 1 outlines some of the major Israeli discoveries of natural gas from 1999 until today, as well as the proven reserves in each of the gas fields.

|

Table 1. Recent Natural Gas Discoveries in Israel |

|||

|---|---|---|---|

|

Discovery Date |

Field Name |

Estimated Reserves (BCM) |

Production Date |

|

1999 |

Noa |

2.3 |

2012 |

|

2000 |

Mari-B |

30 |

2004 |

|

2009 |

Dalit |

7 to 14 |

2013 |

|

2009 |

Tamar |

246 |

2013 |

|

2010 |

Leviathan |

540 |

2016 |

|

2011 |

Dolphin |

2.3 |

unknown |

|

2012 |

Shimshon |

16 |

unknown |

|

2012 |

Tanin |

34 |

unknown |

|

2013 |

Karish |

44 |

unknown |

|

2016 |

Daniel |

246 |

unknown |

It is important to mention that in February 2016, Israeli Energy Minister Yuval Steinitz, gave a new assessment of a potential 2,100 BCMs of natural gas, in contrast to the 680 BCMs that the Tzemach Committee relied on to examine the government's policy regarding the natural gas market.([32])

Israel's Resources opportunities and challenges

These discoveries and the prospect of more discoveries being made in the future, will impact Israel on a number of levels. These impacts constitute both opportunities and challenges for Israel.

From a security perspective, these discoveries will allow Israel to improve its energy security as it reduces its dependence on imported sources of energy for domestic use, substituting them with locally produced natural gas.([33]) For instance, in 2003, Israel produced electricity by using coal and oil. In 2010, Israel consumed 5.3 BCM of natural gas, of which 90 percent went to electricity generation, leading to a savings of 1.4 billion dollars for the economy. ([34])

However, Israel’s dependence on natural gas could be risky because Israel relies on only one production treatment platform and one pipeline to deliver the gas for local consumption.([35]) The gas flow could be threatened by technical problems. Another possible threat may come from nature, like earthquakes. A third danger, and perhaps most significant, is a military one. The fields that are located in the southern waters (Mari-B and Noa) could be easily targeted by Hamas (in Gaza), and those in the northern waters (the Leviathan and Tamar) are within Hezbollah’s missile range.([36]) Also, terrorist acts that could destroy a gas or oil facility by means of a crashing plane, cyber-attacks, guided missiles, Unmanned Aerial Vehicles or suicide boats at sea still exist. ([37])

In order to mitigate some of these risks, the Israeli government took some preventative measures. Israel is planning to build a Liquid Natural Gas (LNG) facility that will draw natural gas supplies from the Tamar Field and the nearby Dalit Field. This would help the country in diversifying its energy sources([38]) Militarily, the Israeli Navy protects offshore gas fields and installations, but with just 3 corvettes, 10 missile boats, 3 operational submarines, and 42 patrol boats; the naval fleet remains insufficient to cover the entire EEZ. ([39])

Economically, Israel is facing many difficulties due to its growing prices and the degradation of salaries and social services; particularly in the housing market.([40]) The domestic use of natural gas can ensure a more viable and a more sustainable economy by making industrial production cheaper and thus more competitive([41]). In addition, the growth of oil and gas exports will provide the Israeli government with a considerable source of income and could allow Israel a very high degree of financial independence.([42])

Scientific research could also benefit from the gas exploration. By searching for the best ways to use the gas in the local market, and by striving to protect gas fields and the infrastructure related to them such as pipelines, refineries, and platforms, Israeli security technology companies could develop advanced technologies.([43])

Moreover, natural gas, if used as source of power for desalination plants, could positively affect the conflict over water in the region([44]). Additionally, a bigger dependence of natural gas would decrease the CO2 emission levels.([45]) However, an environmental risk resulting from offshore gas or oil drilling could be disastrous to not just Israel, but the region at large. An accident, such as even a minor leak, could pollute Israeli beaches (which are vital to its tourist industry) and even endanger its marine natural life. The Israeli government admits that the country does not possess the experience, the tools, the control systems nor the emergency plans to prevent such kind of disasters. ([46])

Finally, the gas fields discovered are large enough to enable Israel to export its resources. Accordingly, the Israeli Cabinet decided to export 40 percent of its production.([47]) This decision is intended to make Israel a viable exporter of natural gas and thus play a positive role in the country’s relationships with its neighbors such as Cyprus, Egypt, Jordan, the Palestinians, and Turkey. For instance, Israel and Cyprus are now planning to reach the European markets by means of a pipeline that goes through the Greek island of Crete, or by building a shared LNG plant at Vassiliko on Cyprus’s southern shore.([48]) Moreover, in early 2014, Israel signed a natural gas sales agreement to provide Jordan with 1.6 trillion cubic feet of natural gas from the Tamar Field over a 15 year period with exports beginning in 2016.([49]) Another agreement approved by the Israeli government is to supply the Palestinian Authority with natural gas from Leviathan Field once production commences in 2017.([50]) Finally, by restoring its relations with Ankara in June 2016, Israel is looking to explore a pipeline both for consumers in Turkey and as a connection to Europe.

The Lebanese-Israeli Maritime Disputed Borders

Lebanon and Israel have never been delineated because they have officially been at war since Israel declared independence in 1948. This on-going dispute over the shared maritime boundary could affect the two countries’ abilities, and in particular Lebanon, to proceed with their offshore development plans because tensions could even make it impossible for firms to work in both countries at once. The two countries have avoided direct or even indirect negotiations to settle the maritime borders. In fact, Lebanon as member of the Arab League, does not recognize Israel. Moreover, Israel recently rejected a compromise proposal put forward by the United States (US) on the dispute. The two countries then went to the UN to claim their rights using the United Nations Convention on the Law of the Sea (UNCLOS) as a legal basis.([51])

It is acknowledged that, in the absence of an agreement, delimitation should take place on the basis of the median line or the equidistance line from the baselines.([52]) Further, a State should proclaim its Economic Exclusive Zone (EEZ) and express its delimitation in its national laws in order to obtain sovereign rights to explore, exploit, conserve, and manage the natural resources included.([53]) UNCLOS article 75 provides that States must deposit charts and lists of geographical coordinates of the EEZ to the UN.([54]) In addition, Mediterranean States should cooperate “in the exercise of their rights and in the performance of their duties” in cases of disagreement, because the Mediterranean Sea is a semi–enclosed one.([55]) Finally, it is worth mentioning that Lebanon ratified UNCLOS in January 1995; unfortunately, Israel is not a party to UNCLOS. However, from a legal perspective, UNCLOS, and in particular the rules relating to maritime borders, binds all countries, including countries which have not signed it, since it has become part of customary international law.([56])

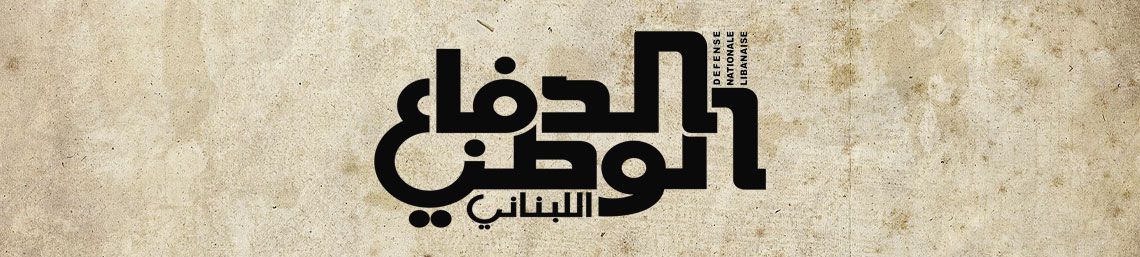

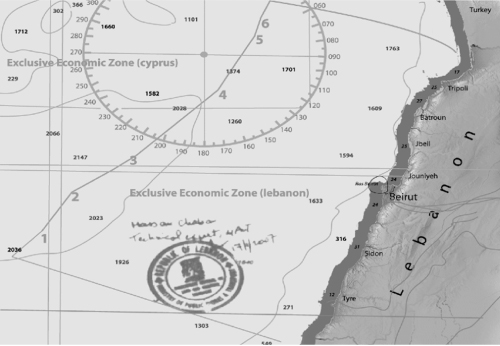

Before going to the UN to proclaim its EEZ, Lebanon started the process of the delimitation of its maritime border. The Lebanese government signed an agreement with Cyprus that delineates its western EEZ border (see figure 1) in defining six equidistant points along a West line from South to North.([57]) However, the Lebanese Parliament did not ratify this agreement due to political pressure coming from Turkey who wanted to include the Northern part of Cyprus in any agreement done by Cyprus. Another reason is that Lebanon wanted to reach a free trade agreement with Turkey; which was actually signed at the end of November 2010.([58]) Therefore, this non-ratified Agreement does not bind Lebanon.

In 2010, the Lebanese government, according to Article 74 of UNCLOS, took the next step by submitting to the UN a chart of geographical coordinates defining the limits of its EEZ, in particular its southern boundary with Israel and its southwestern boundary with Cyprus.([59]) This proclaimed EEZ goes north beyond point 6 and south beyond point 1 (see figure 2).

The boundaries depicted above added two points to the six points of 2007; Point 7 in the north and Point 23 in the south are respectively the northwest and southwest limits of the Lebanese EEZ. Point 23 is seventeen kilometers further. The speculations behind this difference are many. One could be simply a Lebanese diplomatic mistake done during the signing of the agreement with Cyprus in 2007. ([60]) Another explanation, more convincing, is that the Lebanese EEZ ended before reaching the triple point since this would need the involvement of the third state concerned (Israel), to give the opportunity to reexamine the geographical points.([61])

For its part, Israel also began the process of defining its EEZ by signing an agreement with Cyprus on their maritime boundaries in December 2010.([62]) Lebanon rejected this agreement arguing that it conflicts with Lebanon’s EEZ. In fact, this agreement used similar coordinates to the Lebanon-Cyprus Maritime Agreement by taking Point 1 as the terminal point of the northern limit of the Israeli EEZ, but overlapped a surface of 850 km2 with Lebanon’s rights over the maritime area according to its public delimitations at the disposal of the UN office in 2010.([63]) Also, there is a provision in this agreement, similar to the one in the Lebanon-Cyprus agreement that opens the door for future modification.([64])

In July 2011, the Israeli Knesset sent a map to the UN of its maritime boundaries based on this Cyprus-Israel agreement, rejecting the EEZ’s boundary deposited by Lebanon and ignoring its protest.([65]) In this context, Prime Minister Binyamin Netanyahu declared:

Lebanon’s boundary declaration contradicts the line Israel has agreed upon with Cyprus, and what is more significant to me is that it contradicts the line that Lebanon itself concluded with Cyprus in 2007. We have no choice but to set the borders ourselves.([66])

Based upon the positions of both countries through the lists of geographical coordinates submitted to the UN, it is obvious that Point 1 of the Israeli list of geographical coordinates is different from Point 23 of the Lebanese list of geographical coordinates.

In June 2011, Lebanon filed a protest against the Israel-Cyprus Maritime Agreement with the UN. Another letter was sent in September 2011 to protest against the Israeli submission of its EEZ to the UN.([67]) Both letters highlighted the fact that the Israeli delimitation does not match the geographical points that Lebanon had deposited with the UN. The letter added that such attitudes could endanger international peace and security, and argued that Israel’s coordinates violate the 1923 International Land Border established under the Paulet-Newcombe Agreement between France and Britain, and the 1949 Lebanon-Israel Armistice Line([68]) Israel, on the other hand, notes that the Paulet-Newcombe Agreement never defined a point on the coast, and there is no signed map or set of coordinates attached to the Israel-Lebanon 1949 Armistice Agreement. ([69])

This contrast of proclamations and the overlapping zone between the two countries’ EEZ resulted in a disputed area over 850 km2, in the shape of a triangle whose western apex is the Israeli-Lebanese land border and seaward base is Israel and Cyprus EEZs. Both sides agree that Ras al-Naqoura lies on the common land border. However, they disagree on the angle of the line drawn from Ras al-Naqoura toward the Cyprus EEZ. ([70]) The area is relatively small when compared with both countries’ EEZ, which totals 48,000 km2, and does not overlap with the gas fields discovered so far, in particular the Tamar and Leviathan. Nevertheless, the area may contain potentially significant hydrocarbon resources given its location near the center of the Levant Basin.([71])

It is important to note that this legal dispute was accompanied by tensions between the two countries and appeared in the speeches of several Israeli and Lebanese government officials. Lebanese politicians declared that Lebanon has the right to explore its resources. Israeli officials have warned of retaliation for attacks on its oil and gas facilities, and have vowed they won't surrender any gas reserves and will use military forces to protect them.

Although the situation is not so stable on Lebanon’s southern border and can quickly deteriorate, at present the Syrian war has diverted both Hezbollah and Israel for the time being.([72]) This may give a real opportunity for the Lebanese government to continue its process of extracting the resources, allowing the revenues emerging from this sector to significantly improve the quality of life of Lebanese people, and improving the country’s income. As a result, the government has the opportunity to fill the vacuum left to all parties who build much of their support on the provision of social services.

Options for Resolving the Boundary Dispute

It is true that the dispute is mainly between Lebanon and Israel; however, the border between Lebanon and Cyprus is not yet resolved as the Lebanese Parliament refused to ratify the agreement which was concluded between the two countries in 2007. Therefore, Lebanon should consider renegotiating this agreement on one hand, and settle the border dispute with Israel using one of several options cited by Article 33 of the UN Charter mentioned above, knowing that Israel’s and Lebanon’s maritime boundary submissions to the UN are only unilateral proposals.

In light of the circumstances surrounding this question that have been detailed previously, there are not many options in helping to resolve it. Negotiation between Israel and Lebanon cannot be considered as they are at war and will not negotiate face-to-face. Moreover, Israel has not signed UNCLOS, in contrast to Lebanon, which means that the two countries cannot refer to any of the known judicial systems, such as the International Court of Justice, the International Tribunal for the Law of the Sea, or the Permanent Court of Arbitration. Mediation could be the last option available. The UN, the US, or the EU could also play a major role in settling this issue.

Oil and Natural Gas SWOT Analysis

This section presents the new findings using SWOT analysis for Lebanon and Israel and is summarized in the following tables. These tables will identify, for each country, the energy sector potential internal strengths and weaknesses, as well as opportunities for prosperity and threats against each country. SWOT analysis exposes clear and significant strengths and weaknesses of the oil and natural gas discoveries, inherent to the findings themselves. A number of threats were revealed that may endanger the exploration program. The aim behind this study is to think about whether threats and weaknesses can be transformed into opportunities by leveraging the countries’ hydrocarbon sector strengths while confronting their weaknesses.

|

Lebanese Findings using SWOT Analysis |

|

|---|---|

|

STRENGTHS |

WEAKNESSES |

|

Strategic location (close to European market) |

Underdeveloped infrastructure and little experience in the petroleum sector |

|

Good relation with its neighbors (except for Israel) |

Political instability, factionalism, corruption, weak rule of law and low transparency, High Public debt. |

|

Strong banking sector and dynamic and active private sector companies |

Reliance on imported energy for electricity production and for transportation |

|

Prestigious education system which can generate qualified workforce and human resources |

Repeated postponing risks deterring companies who would seek opportunities elsewhere |

|

Extensive and high quality 2D and 3D seismic survey were conducted which can reduce the exploration phase |

Lack of experience will lead to dependence on multinational corporations, especially with the fields depths |

|

Possible benefits from Hezbollah arms if put under government authority |

Unable to protect its resources |

|

OPPORTUNITES |

THREATS |

|

Current attractive prices in the LNG market |

Competition and entry of new players threaten to push prices down |

|

Joint use of energy infrastructure, especially with Cyprus for liquefaction or using the AGP |

Maritime dispute with Israel |

|

Increasing global gas demand |

Environmental and Operational Risks |

|

Potential demand from Europe |

Situation in Syria and the influx of Syrian refugees |

|

Situation in Syria has diverted both Hezbollah and Israel |

In long term, possibility for prices to decrease |

|

Israeli Findings using SWOT Analysis

|

|

|---|---|

|

STRENGTHS |

WEAKNESSES |

|

Developed energy industry |

Reliance on imported energy |

|

Skilled labor |

Geography (hostile surrounding ) of the country |

|

Innovative high-tech sector |

Economic and social difficulties |

|

Most advanced in terms of exploration and production: gas production operations commenced |

Insufficient protection of energy installations especially at sea |

|

Advanced military arsenal |

Non redundancy of infrastructure |

|

Strong institutions |

Insufficient experience in handling disaster |

|

OPPORTUNITES |

THREATS |

|

Alliance with US |

Maritime dispute with Lebanon |

|

Option for the joint use of energy infrastructure, especially with Cyprus |

Technical problems, natural disasters (like earthquakes), military and terrorists attack. |

|

Energy sufficiency, through the development of power generation facilities |

Competition from other countries |

|

Syria crisis may be a source diversion for Hezbollah |

Environmental and Operational Risks |

|

Potential Demand from Europe and Asia |

Negative economic developments in the region, influenced by issues such as the civil war in Syria, could undermine demand, interrupt production and trade, and threaten the viability of several energy infrastructure projects. |

|

Increasing global gas demand |

Deteriorated relation with Turkey |

|

State of fragmentation and weakness of Arab countries |

Conflict with Palestinians to continue |

Impacts of Discoveries on the Conflict between Lebanon and Israel

The new gas and oil discoveries carry tremendous potential for Lebanon and Israel. It is clear that the legal issues between the two countries need time and better circumstances in order to be resolved through peaceful means. As escalation would bring the abstention of IOCs from operating in the region as well as great risk of collusion, the prospect of reaching a settlement for the maritime disputes between the two countries in the field of energy is not to be excluded, for many reasons.

First of all, reaching a settlement is in the interests of both countries. On one hand, Israel is in a very advanced stage of exploration and production of the new resources. The country is exporting its natural gas to its neighbors, and strengthening its relationship with them. In addition, the new findings will boost economic and social developments in Israel. On the other hand, Lebanon, which is still behind in the exploration race despite its potential to produce large quantities of natural gas, is pushing forward its efforts to exploit its share of oil and gas. The revenues from the exploitation of these national resources would provide all of the necessary funds to solve Lebanon’s financial, economic, and social problems. The country could move its economy to an advanced development track and decrease its public debt.

The objective of exploiting of resources can lead to political settlements and resolve the disputes between countries. The most relevant example is the EU, an alliance which was established in 1950 to put an end to the repeated and devastating wars between European neighbors, including two world wars. The idea was that cooperation among countries in the fields of the coal and steel would lead to much more cooperation and to a lasting peace. As a result, six European countries, France and Germany in particular, has started coal and steel production together as a first step to perpetually eliminate wars from Europe. This idea of shared resources production has brought political stability and economic prosperity to members of the EU, which could inspire some hope to countries in the Eastern Mediterranean region.

Prosperity could lead to modernization and thus, to cooperation. Extremism nurtures from poverty. Examples from the Arab countries hit by the Arab Spring illustrates well this fact. In the eastern parts of Syria, the Islamic State of Iraq and al-Sham’s (ISIS) gains do not surprise experts because this region is one of the poorest in the country due to the long time that it was neglected by the central government. Similarly, in the Sinai Peninsula of Egypt, and in Yemen’s rural areas, poverty and unemployment remain major factors cultivating radicalism among militant groups. In Lebanon, Extremism, gained popularity among deprived populations. Once Lebanon starts natural gas and oil production, the country has great potential for developing its economy. People could possibly have greater ease in finding jobs; especially those who benefit from political parties’ allocations. When people earn money and live in prosperity, history reveals that they drop their arms and leave the ranks of their militias. Moreover, politicians who support militias at present, usually change caps and follow their interests in pursuit of the revenues from newly found wealth. Modernization can win against extremism and a feeling of well-being among people holds the greatest potential for improving the situation and easing tensions in the overall Lebanese-Israeli conflict.

Both countries have huge enormous capacities of natural gas and oil fields in their EEZs that could not possibly be fully consumed by the Israeli and Lebanese markets alone. Therefore, to make the exploration economically practical, each country needs to find ways to export the extra quantities. Two alternatives are possible: building a pipeline or investing in a LNG plant; especially if the gas will be exported to Europe. Therefore, it is unwise or unworthy to build multiple pipelines or even multiple LNG plants because construction of such pipelines or terminals would incur enormous costs. Lebanon and Cyprus can cooperate in exploiting these resources with funding provided by any European country interested in diversifying its investments in a way that could help this country to benefit from the flow of Lebanese oil and gas into the European market. Another opportunity could be to use the existent AGP infrastructure that connects several Arab countries and transport gas further to multiple consumers in the region.

Regional and international players will push for cooperation between the two countries too. First, The EU is pursuing its efforts to increase its energy security and reduce reliance on Russia in the light of the Crimean crisis through diversification of gas imports. It is logical to assume that Russia will undoubtedly dialogue with Levant countries in order to create the conditions for mutual benefits from energy resources, especially knowing that the EU can offer investments, specialized technology and expertise. Second, The US is also involved in the new resources exploration through its IOCs; in particular, the Texas-based Noble Energy Company. As Noble Energy is the primary explorer in Israel, Washington has a keen interest in ensuring that the potential economic windfall in the Levant does not become an additional reason for war. The American partnership in the exploitation of such natural gas deposits, as well as oil, is considered a big incentive to mediate both current and future disputes between Israel and Lebanon. The US can (and should) assume the role of helping to defuse other potential causes for conflict, which would allow both countries to peacefully explore the hydrocarbon wealth beneath their waters, and thus present further opportunities to more US oil companies to sign exploration contracts.

[1] BEMO Industry Report, “Hydrocarbons in Lebanon”, Issue # 1/2014, accessed 10 September 2014, http://www.bemobank.com/files/Hydrocarbons.

[2] Ibid.

[3] George Sassine, “Lebanon’s electricity sector between regulation and decentralization,” A new vision for Lebanon, December 2012, accessed 16 September 2014, http://www.georgessassine.com.

[4] Gebran Bassil, “Policy Paper for the Electricity Sector,” Ministry of Energy and Water, June 2010, accessed 16 September 2014, http://www.tayyar.org/tayyar.

[5] BEMO Industry Report.

[6] Central Intelligence Agency, “The World Factbook, Lebanon, Economy,” 20 June 2016, accessed 8 August 2016, https://www.cia.gov.

[7] Ibid.

[8] Ibid.

[9] Middle East Strategic Perspectives, “Lebanon’s emerging oil & gas sector: a discussion with Energy Minister Arthur Nazarian,” 31 August 2014, accessed 8 September 2014, http://www.mestrategicperspectives.com.

[10] Ibid.

[11] Ibid.

[12] Lebanese Petroleum Administration, “The Offshore Petroleum Resources Law (OPRL), Article 3,” 13 January 2011, accessed 17 September 2014, http://www.lpa.gov.lb.

[13] Compressed Natural Gas CNG Conversion Installs, “Environmental Benefits of CNG converted Vehicles,” 25 April 2013, accessed 16 September 2015, http://cngconversioninstall.com/evironmental-benefits/.

[14] Daily Star Lebanon, “Warm weather, weak wind make Beirut air pollution worse: study,” 5 February 2011, accessed 16 September 2014, http://www.dailystar.com.lb.

[15] Daniel Atzori, “Levant Basin: What lies within?” ABO - About Oil, Interview with Filippo Diomigi, London School of Economics Fellow, 20 January 2014, accessed 16 September 2014, http://www.abo.net/oilportal.

[16] Ibid.

[17] Ibid.

[18] Map Action, “Lebanon, Baseline Information,” 10 October 2013, accessed 16 September 2014, http://www.mapaction.org.

[19] Ibid.

[20] Transparency International, “Corruption Perceptions Index 2015,” 2015, accessed 17 August 2016, http://cpi.transparency.org.

[21] BEMO Industry Report.

[22] Ibid.

[23] Ibid.

[24] Middle East Strategic Perspectives.

[25] Ibid.

[26] Ibid.

[27] World Economic Forum, “The Global Information Technology Report 2015,” 2015, accessed 17 July 2016, http://www3.weforum.org/docs/

[28] Ibid.

[29] Ibid.

[30] Nathanson and Levy.

[31] Walid Khadduri, “East Mediterranean Gas: Opportunities and Challenges,” Mediterranean Politics, Vol 17, No. 1, (March 2012): 111-117, accessed 30 April 2014, http://www.tandfonline.com

[32] Ministry of Energy and Water Resources of the State of Israel.

[33] Arab Center for Research and Policy Studies.

[34] Ministry of Energy and Water Resources of the State of Israel.

[35] Allison Good, “Defending Israel natural’s gas,” Foreign Policy, 13 January 2014, accessed 10 September 2014, http://mideastafrica.foreignpolicy.com.

[36] Nathanson and Levy.

[37] Good.

[38] Ministry of Energy and Water Resources of the State of Israel.

[39] Ehud Eiran and Yaval Zur, “Israel’s Missing Naval Strategy,” Foreign Affairs, 19 March 2013, accessed 10 September 2014, www.foreignaffairs.com.

[40] Gardner Patterson, “Israel's Economic Problems,” Foreign Affairs, accessed 13 September 2014, http://www.foreignaffairs.com.

[41] Arab Center for Research and Policy Studies.

[42] Ibid.

[43] Israeli Ministry of economy, “Israeli Technology in the Oil & Gas Sector,” accessed 8 September 2004,.http://www2.kenes.com/watec-israel/Documents/OilGas.pdf.

[44] Arab Center for Research and Policy Studies.

[45] Ibid.

[46] Nathanson and Levy.

[47] Claudia Assis, "Israel Clarifies Gas Export Policy: We’re Keeping 60 percent," Marketwatch, 19 June 2013, accessed 10 September 2014, http://blogs.marketwatch.com.

[48] Daily Star Lebanon, “Cyprus Signs LNG Deal with US-Israeli Partnership,” 26 June 2013, accessed 12 September 2014, www.dailystar.com.lb.

[49] EIA.

[50] Ibid.

[51] UNCLOS Articles 74 and 83.

[52] Swiss Association for Euro-Arab-Muslim Dialogue, “The Legal Framework of Lebanon’s Maritime Boundaries: The Exclusive Economic Zone and Offshore Hydrocarbon Resources,”November 2012, accessed 17 September 2014, http://bric.lebcsr.org..

[53] UNCLOS, art. 56.

[54] Ibid., art. 75.

[55] Ibid., part IX

[56] Swiss Association for Euro-Arab-Muslim Dialogue.

[57] Middle East Economic Survey, “Agreement between Lebanon and Cyprus on the Delimitation of the Exclusive Economic Zone,” accessed 10 September 2014, http://www.mees.com.

[58] Daniel Meier, “Lebanon’s Maritime Boundaries: Between Economic Opportunities and Military Confrontation,” University of Oxford, June 2013, accessed 16 September 2014, http://lebanesestudies.com.

[59] UN Maritime Space: Maritime Zones and Maritime Delimitation, “List of geographical coordinates of points,” 12 July 2012, accessed 4 September 2014, http://www.un.org/depts/los/LEGISLATIONANDTREATIES/STATEFILES/LBN.htm.

[60] Hassan Lakkis, “Negotiation Blunders Jeopardize Oil and Gas Campaign,” Daily Star Lebanon, 14 July 2011, accessed 10 September 2014, http://www.dailystar.com.lb.

[61] Swiss Association for Euro-Arab-Muslim Dialogue.

[62] UN, “Agreement between the Government of the State of Israel and the Government of the Republic of Cyprus on the Delimitation of the Exclusive Economic Zone,” 17 Decembre 2010, accessed 10 September 2014, http://www.un.org

[63] Swiss Association for Euro-Arab-Muslim Dialogue.

[64] “Agreement between Israel and Cyprus, Article 1(e).”

[65] UN Maritime Space: Maritime Zones and Maritime Delimitation, “List of Geographical Coordinates for the Delimitation of the Northern Limit of the Territorial Sea and Exclusive Economic Zone of the State of Israel in WGS84,” accessed 10 September 2014, http://www.un.org/depts/los/LEGISLATIONANDTREATIES/

PDFFILES/isr_eez_northernlimit2011.pdf.

[66] Herb Keinon, “Cabinet Approves Northern Maritime Border,” Jerusalem Post 10 July 2011, accessed 10 September 2014, http://www.jpost.com.

[67] Adnan Mansour, “Letter to the Secretary-General of the United Nation,” accessed 10 September 2014, http://www.un.org.

[68] Ibid.

[69] Nathanson and Levy.

[70] Helmi Moussa, “US Tries to Mediate Lebanon-Israel Maritime Border Dispute,” Al-monitor, 2 October 2013, accessed 10 September 2014, http://www.al-monitor.com.

[71] EIA.

[72] Ibid.

تأثير اكتشافات النفط والغاز الطبيعي على الصراع اللبناني - الإسرائيلي

قد يشكّل اكتشاف حقول ضخمة من النفط والغاز في حوض المشرق احتمالًا لحصول تطوّر اقتصادي ونموٍّ في ثروات بلدان المنطقة. هذه الاكتشافات من شأنها أيضًا أن تحسّن قطاع الطاقة في بلدان كانت مستوردة للنفط والغاز الطبيعي منذ تأسيسها. ونظرًا إلى كلّ كمية الموارد المكتشفة، وبالاعتماد على سرعة هذه البلدان في التحرك وإدارتها الجيدة للثروة المستجدة، يمكن لبلدان المشرق أن تنضمّ إلى نادي البلدان المصدّرة للمواد الهيدروكربونية.

من المعلوم أنّ لبنان لا ينعم بموارد غازية أو نفطية رغم موقعه الجغرافي في الشرق الأوسط وهي منطقة معروفة تاريخيًا بكونها غنية بموارد الطاقة، كما أنّه لم يتم تسجيل أي اكتشافات كبيرة في مجالي النفط أو الغاز. ومنذ إعلان الاستقلال العام 1943، بدأت البلاد بالبحث عن النفط عبر حفر العديد من الآبار برًا إلّا أنّ الحكومة ألغت تراخيص التنقيب مع بدء الحرب الأهلية اللبنانية العام 1975بما أنّ النتائج كانت ضعيفة.

وتظهر الفوائد المحتملة لتوفّر مخزون محلّي من الغاز بشكل واضح في لبنان فهي قد تضع حدًا للتقنين في التيار الكهربائي، كما قد تلغي الدين العام الآخذ بالارتفاع سريعًا، إضافة إلى إعادة إحياء الاقتصاد وتنمية المجتمع وخفض نسبة التلوّث.

من جهة ثانية، سيعمل لاعبون دوليون وإقليميون على التوصل إلى تسوية بين لبنان وإسرائيل من خلال هذه الاكتشافات النفطية، ومن المعلوم أنّ الاتحاد الأوروبي يسعى إلى مواصلة الجهود لتعزيز قطاع الطاقة لديه وتقليص اعتماده على روسيا، في ضوء أزمة ضمّ القرم، من خلال تنويع مصادر استيراد الغاز. ومن المنطقي الافتراض بأنّ روسيا ستطلق من دون أدنى شك حوارًا مع بلدان المشرق بهدف خلق الظروف المناسبة للاستفادة بشكل مشترك من موارد الطاقة، خصوصًا مع العلم بأنّ الاتحاد الأوروبي يمكن أن يقدّم استثمارات في مجالي التكنولوجيا والخبرات. وتشارك الولايات المتحدة أيضًا في الاكتشافات الجديدة في موارد الطاقة من خلال شركاتها النفطية العالمية وبخاصة شركة "نوبل إينيرجي كومباني" ومقرّها ولاية تكساس. ونظرًا إلى أنّ شركة "نوبل إينيرجي" تشكّل الشركة الأولى في مجال التنقيب عن الغاز في إسرائيل فقد أبدت واشنطن اهتمامًا شديدًا في ضمان ألا تتحوّل الثروة الاقتصادية غير المتوقّعة إلى سبب إضافي لاندلاع الحرب. وتُعتبر الشراكة الأميركية في مجال التنقيب عن مخزونات النفط والغاز الطبيعي حافزًا كبيرًا لأداء دور الوسيط خلال أي نزاعات حالية أو مستقبلية بين لبنان وإسرائيل. ويمكن للولايات المتحدة، لا بل يجدر بها، أن تؤدي دور المساعدة على نزع فتيل أي أسباب أخرى محتملة لحدوث نزاعات، الأمر الذي سيسمح لكلا البلدين باستكشاف ثروتيهما الهيدروكربونية تحت مياه البحر بسلام، وهذا ما يطرح أيضًا فرصًا إضافية أمام المزيد من شركات النفط الأميركية لتوقيع عقود استكشاف.