- En

- Fr

- عربي

Structural Adjustment and its adaptability to Lebanon

Introduction

Structural adjustment programs (SAPs) are loans provided by the International Monetary Fund (IMF) and the World Bank (WB) to countries that experienced economic crises to balance economic recession. The two institutions impose on borrowing countries to implement structural adjustment policies as condition for obtaining loans or a rescheduling of existing ones. SAPs aims at reducing the financial and budgetary deficits of the borrowing country in order to bring economic growth back. The IMF usually implements stabilization policies while the WB takes in charge of adjustment measures. SAPs aim through the implementation of free market rules and policies to make the economies of the developing countries more market oriented in order to boost their economies. These programs include: deregulation, privatization, downsizing of the public sector, reducing public expenditures and removing all trade barriers. Failing to implement such policies will simply lead countries into bankruptcy.

Structural adjustment programs implemented by the International Monetary Fund and World Bank Studies have supporters and opponents. Many view the program as a necessary procedure to resolve economic crisis, while others oppose the view and focus on the social negative consequences of the Structural adjustments policies programs.

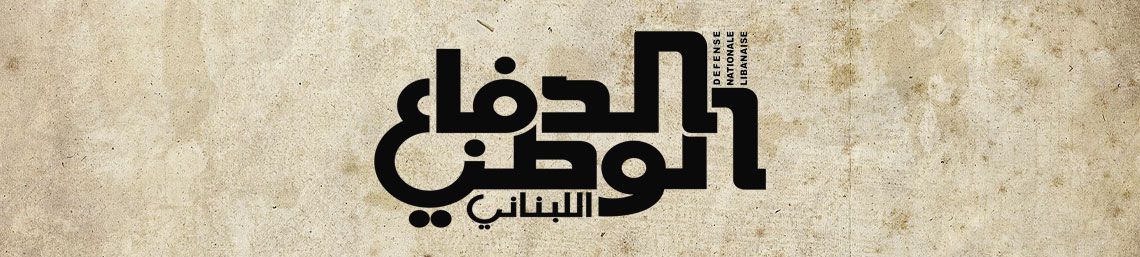

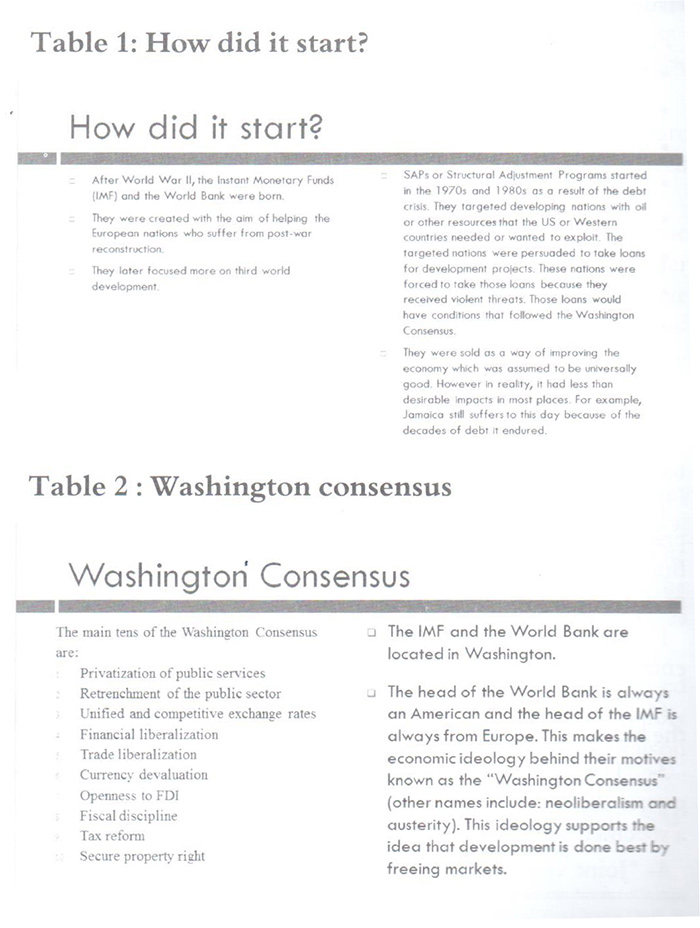

Type of conditions required by the IMF

The goal of adjustment policies is to accelerate economic growth through the reduction of the role of governments in order to open the country to international trade and foreign investments.[1] The government privatizes its public sectors, devalues the currency, reduces tax on high earners, and cuts down on social spending and health care. This procedure allows the country to open up to the foreign competition.

These conditions –referred to as conditionality rules- aim to encourage and accelerate economic growth of countries in order to sustain them, and to pay back their loans. They are: Privatization of public services, Reduction of the expenditure of the public sector, trade and financial liberalization, currency devaluation, fiscal discipline, securing property rights, and openness to Foreign Direct Investments.

Secure property right

Each SAP program has its own conditions according to the severity, duration, and goals to achieve for specific countries. On average, conditions vary between 14 and 26 conditions such as Financial sectors, Monetary policy, Central Bank issues, Fiscal issues, Revenue, Trade and International issues, Revenue and tax issues, State owned enterprises reform (privatization), Labor issues, Redistributive policies, Institutional reforms, Review of social policies, land and environment.

The main Structural Adjustment Policies required by IMF and World Bank for providing loans are divided as follows:[2]

1. Financial Sector, Monetary Policy& Central Bank Issues

Financial institutions

• Legal reforms, regulation, and supervision

• Corrective actions in problem banks

• Privatization of financial institutions

• Bankruptcy proceedings of financial institutions

• Audits of financial institutions

• Policies related to insurance companies

• Treasury bill issuance and auctions

• Government securities

• Monetary policy

• Reserve money

Privatization of public enterprises: New management tools

The other conditions for providing loans by the IMF are privatization, downsizing of government structures, currency fluctuation, and stopping subsidies. Privatization can be performed under the different following forms:

1- “Divestiture” which is the complete selling of public enterprises to the private sector.

2- “Management Contract” form which is the transfer of only the management of public enterprises to the private sector.

3- “Lease contract” from which is the transferring of the ownership and management of public enterprises or agencies for a specified time and revenue.

4- “Joint ventures” which consists of the participation of the private and public sector in management and ownership of the public enterprises.

5- “Liberalization” is explained by the entry of the private sector to compete with the public one without any transfer of ownership and management of public enterprises.

6- “Incremental Privatization” indicated by the shift of the whole economic sectors from public to private sector.

7- Private, Public Partnership” (PPP): Today, the literature has introduced a new concept that is the partnership between public and private sectors.

The structural adjustment policy SAP focuses on the privatization of state-owned enterprises and resources in order to increase efficiency and investment and to decrease state deficit. The major challenge in such case is the fact that state-owned firms and businesses are losing money because they are fulfilling a social function by providing low cost utilities and by hiring large numbers of employees that are unnecessary which can be labeled as disguised unemployment[3].

This change of policy concerning public enterprises management aims to achieve the move from a procedural administration to an accountable administration. The pursued objectives included the increase in productivity, the improvement of the efficiency and the quality of services provided to customers.

However, the public administration found itself opposed to the logic of the market because of its traditional monopoly situation as well as the social function that was its main raison d’être.

In the framework of public enterprises management, SAP approach, the emphasis was placed on the following:

- The shift from a process orientation to a result orientation.

- The shift from monopoly to competition.

- The shift from autonomy to collaboration.

- The shift from one administrator function to a team oriented focus.

- The shift to a consumer focus and the search for a better communication with the exterior environment.

- The shift from centralization to decentralization.

- The emphasis on performance, transparence and accountability.

- The shift from monopoly to competition in the management of public enterprises.

- The move from a process which has long been essentially normative and based on regulations, towards a concept of service directed towards the public, soliciting the participation of the latter and justifying itself by the satisfaction it raises within among its users.

Currency devaluation

A state devalues its currency when it is unable to pay its foreign debts or fulfill its financial domestic obligations such as paying its employees’ salaries; Financing its imports of strategic products it needs such as food and energy; And when the interaction of market forces and policy decisions make the currency's fixed exchange rate indefensible. In order to maintain a fixed exchange rate, a state must have adequate hard currencies reserves to purchase all offers of its currency at the fixed exchange rate. In case a state cannot buy back its own currency, its currency becomes untenable and must be devaluated to a level that allows protecting its foreign exchange reserves.

The other policy issues that might push a state to amend its fixed exchange rate happens when the state rather than implementing unpopular tax and tariff policies and a decrease of social spending or subsidies to basic commodities, resorts to devaluation to carry out its obligations.

The IMF requires as condition to give its desperately needed loans that the currency exchange price of the country’s currency be determined by the Market and not by its Central Bank above its real value. According to the IMF, that strategy would help in fighting the currency black market by closing the significant gap between official and black market rates because the double currency pricing system may provoke a shortage of hard currency and of basic foods supplies and a high inflation and send prices soaring. One example of currency devaluation in order to benefit from the SAP is Egypt which has liberalized its exchange rate and devalued its currency by more than 50% in a desperate attempt to secure a $12bn International Monetary Fund loan to save the country’s economy.

Egypt Central Bank decides after a lot of hesitations to let the Egyptian Pound float for the first time in decades notwithstanding the fact that it will generate a lot of volatility on the short term, whereas the value of the pound would be determined by supply and demand.

The existence of a currency black market in Egypt had provoked a shortage in basic food supply, double digit inflation, a dangerous decrease in the Central Bank hard currency reserves, a soaring price hike and decreased hard currencies availability to pay for imports, and the flow of foreign investments.

The IMF has required the devaluation of Egypt Pound as well as other difficult reforms before freeing the cash package.

A most recent, example is Pakistan that in return for an IMF loan of 6 billion dollars has accepted all IMF conditions including: Market based Exchange rate through the devaluation of Pakistani Rupees.; Removal of subsidies; and Increase in Tax collection.

Downsizing of public sector and removal of subsidies

The IMF constant policies require downsizing the size of the government and the reduction of social services provided for government employees and their families, as well as the reduction of pension plans and services. Such policies have been often met by riots and demonstration's and have caused a rise in poverty and social problems. But, the IMF and the World Bank linked any financial assistance to requesting countries by linking the financial aid to the achievement of SAF results. Money was disbursed in tranches and not in one time.

On the other hand, waiving subsidies have provoked the disappearance of a number of economic activities that were unable to compete with international companies and businesses leading to an increase in unemployment. These policies were applied on the different countries that have benefited from IMF loans. They include” Greece, Ireland, and Argentina that suffered from large public debts and were close to complete bailout especially during the global financial crisis of 2008...

The financial crisis of 2008

Faced by a severe economic and budgetary crisis that affected a number of European countries such as Greece, Portugal, and Spain, the European Union together with the IMF created the European Financial Stability Facility (ESFS) in May 2010 to safeguard financial stability through financial assistance to Euro-zone countries. The purpose of the ESFS was specifically to help resolve the resulting European debt crisis, calm financial markets, restore confidence in the euro, and prevent contagion to other Euro-zone countries and banks holding large amounts of European government debt. The European central Bank (ECB) agreed to purchase Euro-zone government and private debt to provide liquidity to those securities markets facing difficulties. The ECB also made it easier for countries like Greece and Ireland to borrow by suspending collateral rules that required a minimum investment grade rating. The ECB, for example, accepted Greek government bonds despite their poor rating by the three major rating agencies.

Greece structural adjustment policy

The cause of the Greek financial crisis can be dated back to 1980. The leftist social government engaged in large spending and borrowing which lead to a double-digit fiscal deficit for 16 years. Throughout this period, structural economic problems began to emerge: Inflation, excessive bureaucracy, and a high unemployment rate, greatly affecting the economy.

In 2001, Greece joined the European Union hoping that this decision would ensure Greece’s stability and open up new economic possibilities for the future. After joining the Euro-zone, Greece experienced illusionary growth with a rise in income and wages. The economy’s weakness first appeared after hosting the summer Olympics in 2004 due to low exports and high corruption which greatly affected the deficit. The deficit could no longer be balanced without borrowing on the global market at a very high rate. By 2007, the public deficit reached 7% of GDP and 16% by 2009. Governmental Instability, Bureaucracy, tax evasion, and corruption increased public deficit. By 2008, Greece`s debt in relation to GDP reached 109.4% and continued to increase to 179% by 2016[4]. Until 2009, all state expenditures were based on external borrowings at a steady rate exceeding revenues. By 2010, the economic and fiscal situation became unbearable and required new loans to cover the extensive government debts.

By 2010, Greece’s economy was critical and the global banking system was reluctant to continue to financially support the Greek economy due to high-interest rate demand, leaving the state in uncertainty. Greece being a member of the Euro-zone, sought out to get a loan of 239 billion Euros. Greece concluded three consecutive agreements “Memorandums” in 2010, 2012, and 2015. Memorandums are economic aids from the three creditors, the European Union, European Central Bank, and the IMF which aim to radically restructure the economy and bring growth back again.

The three Memorandums had a strong socio-economic impact on Greece. A Tax increase was added on almost everybody and everything: Prices became very excessive, salaries were reduced, taxes were increased sharply, pension’s plans cut, and downsizing affected the public administration. Every memorandum was increasing the latter measures: Poverty and social exclusion increased from 28.1% in 2008 to 35.6% in 2016. The poverty line-a norm used to define poor people income- was decreased from 7219 Euros annually in 2008 to 5297 Euros in 2016. Anyone with an annual salary over the poverty line was excluded from benefits and social transfers. The unemployment rate of the active population rose from 7.8% in 2008 to 23.6% in 2016. Moreover, the unemployment rate for the young generation aging from 15 and 24, doubled from 22.5% in 2008 to 51.9% in 2016[5]. Although, the financial situation has improved after a 7-year long crisis plan, the future of Greece’s stability is still debatable[6].

The first package included:

-A uniform pay scale for civil servants. Wages cut by 30% and freezing of bonuses.

-Labor reserve offers civil servants who are dismissed 60% of their pay for one year.

-The tax-free reduction for income tax was lowered from €12,000 to €5,000.

-Monthly pensions above €1,200 cut by 20%. Retirees under 55 years old, the pension over €1,000 is cut by 40%.

-Lump sum for retirees is cut by 20% to 30%.

-Education spending cut by closing or merging schools.

In return for asking for a 130 billion Euros loan the package included:

- 22% cut in minimum wage from €750 to €585 per month.

-Permanently canceling holiday wage bonuses (one extra month's pay each year).

-150,000 jobs cut from state sector by 2015, including 15,000 by the end of 2012.

-Pension cuts worth €300 million in 2012.

-Health and defence spending cuts.

-Industry sectors are given the right to negotiate lower wages depending on economic development.

The first round of measures was approved by the Greek parliament on 16 July 2015. The measures included.

-Rise of tax for incomes over €50.000.

-Luxury tax rise.

-Rise of health contributions paid by pensioners (6% from 4% ).

-Diesel fuel tax for farmers going from €6 per 1,000 liters to €200/1,000 liters from October 1, 2015, and to €330 by October 1, 2016.

-Farmers’ income tax to be paid in advance would rise from 27.5 percent to 55 percent.

-Private education, previously untaxed, would be taxed at 23 percent, including the tutoring schools (frontistiria), but excluding preschools.

-Reduced value-added tax rates for islands are to be abolished completely by the end of 2016, with enforcement staggered across three groups of islands from October 1, 2015 to January 1, 2017.

-Interest on expired debts to the state that are payable in 100 installments is to rise from 3 percent to 5 percent on amounts over €5,000. Amounts below €5,000 are not subject to interest provided they meet certain conditions.

-Greece’s shipping industry would also be subject to new tax rises.

Another package included:

-Pensions calculated as the sum of basic and contributory pensions.

-Minimum pension age rose to 67 retroactive to 1 July 2015

-Existing public sector pensioners younger than 67 received a 10% decrease in their pensions until they reach that age (excluding disability pensions).

-Armed forces pensions revert to the 3865/2010 Law regimes. Veterans eligible at 61 years of age, or after 40 years of service.

-ΑΚΑΓΕ special auxiliary pension fund abolished.

The first round of measures mostly affected pensions saving €3.6 billion. The measures voted on 8 May include:

- Cuts in new pensions.

-Reducing higher pensions.

-Increased insurance contributions.

-VAT increased to 24 percent.

-Higher fuel taxes.

-New excise taxes, such as coffee and electronic cigarettes.

-increased excise taxes on tobacco and ENFIA tax.

-Tourism tax affecting hotels from 2 stars and up.

-Tax on TV subscriptions, landlines and internet broadband connections.

Ireland structural adjustment policy

Ireland’s economy has been on the rise before its acceptance as member into the European Union. Ireland competitive interest and low inflation rates attracted large investments from its neighboring European countries. Once Ireland became a member of the European Monetary Union (EMU) in 1999, the country adopted the Euro currency, The country’s nominal interest rates became set by the European Central Bank (ECB) at a lower level for the benefit of the larger euro area to maintain price stability in the Euro-zone. The Central bank of Ireland could no longer determine and implement its monetary policy.

The property and banking markets

By the year 2000, the economic confidence in Ireland led to substantial growth in the financial, residential and commercial property markets. The government played an active role in the expansion of Ireland’s real estate market with its favorable tax treatment compared to the EU zone. The government provided tax reduction on mortgage interest payments and limited taxes on residential property. Residential prices rose over 400% until 2007 the highest in the EU[7]. Supply was unable to keep up with demand which leads to the rapid growth of buy to lease market. The substantial increase in construction, led to a significant increase in the demand for labor in construction along with an increase in wages pressuring Ireland’s wage competitiveness.

In 2002, the government of Ireland shifted to a new regulatory model. The Irish Government created, for the first time, a single regulatory authority for financial services housed within the Central Bank of Ireland. The role of the new entity, the Irish Financial Services Regulatory Authority (IFSRA), was to coordinate, integrate and oversee the supervision of Irish financial institutions such as banks, insurance, and securities companies, and to protect consumer interests as they relate to financial institutions. While operating within the Central Bank of Ireland, however, the IFSRA had its own Chief Executive, Chairperson, Board, and staff to carry out its functions independently. The new, combined entity was called the Central Bank and the Financial Services Authority of Ireland (CBFSAI)5.

Ireland’s economic climate included a weak financial regime from micro and macro perspectives. Regulators adopted a principle-based and deferential regulatory approach to the banking industry including reliance on the bank’s internal risk models. This provided the opportunity for questionable accounting practices. Moreover, the regulators missed two warning signs involving the systematic risk in the banking system. The first warning was a result of a higher than average balance sheet growth throughout 1998-2000. The second was the highly concentrated and high-risk nature of the bank’s loan activity to property developers. However, the most crucial factor was the lack of supervision which leads to the financial crisis, and the bank risk management models.

This regulation model led to the decrease of the investment grade of the Irish banks from AA to A- resulting in the withdrawal of 18.5 billion Euros from their accounts[8].

The Government’s Response

In 2008, in response to the global financial crisis, the government initiated a decisive and courageous plan to rescue the financial sector and maintain the health of the banking sector. In response to the global financial crisis, a 14-month plan with severe pay cuts for public workers and welfare programs was approved while reinstituting university fees, and raising taxes and income taxes on high-income workers. In 2010, a 4-year plan to stabilize the economy was approved by adding further cuts to welfare programs, minimum wages, and increasing taxes.

The government passed the Central Bank Reform Act in 2010 which created a single consolidated organization known as the Central Bank of Ireland with responsibility for both central banking and financial regulation of banks in Ireland. The main goals of the reorganized Central Bank, in addition to price stability, are to contribute to financial stability both in Ireland and across the euro area through macro-prudential oversight, including monitoring overall liquidity for the banking system; to ensure proper and effective micro-prudential regulation of financial institutions and markets as well as protecting customers and investors.

Ireland’s Decision

In November 2010, an agreement was reached between Ireland and the IMF, the euro zone’s European Financial Stability Facility (EFSF), and the European Commission’s European Financial Stability Mechanism (EFSM). Ireland, upon its request, would receive a three-year package loans to cover financing needs up to €85 billion. The deal would involve two funds. The first fund recapitalizes Irish banks and helps them deal with rising losses on their loan portfolios. The second help fund the government’s budget deficit without resorting to the bond markets. In return, the government agreed on an austerity program to cut €15 billion from its deficit over the 2011-14 fiscal years through spending cuts and tax increase and to reduce the budget deficit from 32% of GDP to 3% by 2014[9]. The agreement called for no change in the 12.5% corporate tax rate so that Ireland’s economic recovery and debt repayment would be easier to achieve. The arrangement would be reviewed quarterly against quantitative performance criteria and benchmarks, in conjunction with the IMF, to ensure timely and appropriate implementation.

In December 2010 the Irish parliament voted to request a €67.5 billion EU/IMF bailout package. The funds would come equally (€22.5 billion each) from the EFSF at 6.05% interest (includes bilateral loans of €4.8 billion from the UK, Sweden, and Denmark), and the EFSM and IMF at 5.7% interest. The average life of the borrowings, which include both short and long-dated maturities, is 7.5 years. Ireland would contribute €17.5 of its funds to the package from its accumulated cash balances and national pension reserve fund[10]. The package would provide Ireland with the vital time and space the country needed to address the problems the country had been dealing with since the global economic crisis began.

A request by Ireland to the ECB to extend its payment schedule on the borrowed funds was approved in early 2013 in return for the liquidation of two financial institutions including the Anglo Irish Bank at the expense of bondholders.

Argentina economic crisis: Overvaluation of the Peso

Argentina’s financial crisis dates back to 1998. The depression spanned over 4 years following the 1974-1990 great depression that resulted from the accelerated growth of the economy. In 1991, Argentina’s government decided to fix the currency rate to the US dollar at a 1.1 ratio to lower hyperinflationary price rates[11]. The decision was a success. While countries such as Brazil, China, and Mexico, were devaluing their currency due to a financial crisis, Pub. Edward Elgen, Argentina pesos was constantly appreciating against European countries currencies.

Yet, Argentina was burdened by debt service. With the overvaluation of the peso, the real wages declined, along with an increase in the people living on and under the poverty line. Eventually, the ratio was dropped in 1997 leaving behind a high unemployment rate, imbalance in the real sector of the economy, deflation and recession as well as issues in external, and banking imbalances.

Argentina’s account deficit and private financial outflow lead to a sizable increase in foreign debt. Furthermore, an imbalance appeared when the currency was devalued and the debtors could no longer work in a tradable sector. The US dollar was constantly increasing, and the balances could no longer be settled. The peso has become extremely vulnerable in the international emerging financial market.

Banking Imbalances

Two factors were contributing to imbalances in the banking sector. The first, bank profitability was low and becoming negative for many sections of the industry. Second, the proportion of non-performing loans– in spite of many efforts to cover up the phenomenon – was skyrocketing. An additional risk factor was the increasing proportion of bank assets being taken up by the public sector. As a result, the banking sector was becoming vulnerable to the fiscal difficulties in Argentina.

Argentina has been steadily recovering from its crisis in 2001 when it was then followed by a collapse in 2009 in the global crisis. Argentina received a Stimulus package from the IMF to deal with its financial crisis with a focus on labor markets and social policies[12].

In 2019, Argentina which has concluded 22 different agreements with the IMF will receive a 57 billion dollars loan the biggest one in IMF history to achieve SAP including a commitment to running a zero-deficit primary budget.

Lessons for Lebanon

After years of instability, the performance of the Lebanese public sector deteriorated due to the huge physical losses, absence of good management, lack of governmental supervision, scarcity of resources… etc. Besides, the huge governmental expenditures to rehabilitate and renovate the infrastructure, and to reconstruct the governmental infrastructure, resulted in increasing the public debt and limiting the capacity of the Lebanese government in restructuring public enterprises for the recovery of Lebanese economy. The budget deficit reached 11 percent of GDP in 2018, up from 8.6 percent in 2017. The primary balance deteriorated to 1.4 percent of GDP due to an unexpectedly costly salary scale increase implemented in late 2017 as well as new hiring. Tax revenues were also weaker than forecast. Given the large public debt (151 percent of GDP in 2018), interest payments now exceed 9 percent of GDP[13].

Lebanon is no exception when it comes to SAP adoption and implementation. The IMF and the WB have been calling upon the Lebanese government to adopt a strategy similar to SAP without calling on them to step in. The major recommendations to decrease the public debt that has reached a huge percentage above the GDP are :

- The reduction of the budget deficit through cutting on spending through a policy of institutional change that includes reviewing the raison d’être of public agencies and public administration and making sure that they are still necessary.

Decreasing spending whenever applicable mainly through institutional changes and the adoption of management principles based on accountability and transparency.

-Reviewing subsidies and trying to reduce their cost or the way they are awarded.

-Decreasing the size of the public sector through a policy of hiring back one out of two employees who retire.

-A review of social spending and trying to reduce its cost by a strict control policy while providing citizens with decent health care.

-Reviewing pension plans for new employees because the cost of pensions is soaring.

-Engaging in an economic model based on innovation and entrepreneurship.

-Fighting corruption

-Refrain from creating new taxes in the framework of an economic crisis because taxes kill taxes.

-Promoting Public Private Partnership; PPA is one of the most convenient solutions to minimize the growth of public debt. The major role of PPA is to make public enterprises more productive and efficient, introduce innovation of managerial and institutional strength, and reduce Bureaucracy[14].

-Getting rid of all public agencies that are inefficient.

-Promoting new economic activities.

The IMF has emphasized the importance of implementing the following policies:

“Strengthening the Lebanese economy requires action in three areas: A credible medium-term fiscal plan aiming for a substantial and sustained primary fiscal surplus that would steadily reduce the public debt-to-GDP ratio over time.; Fundamental structural reforms to boost growth and external competitiveness, starting with improving governance as well as the implementation of the electricity sector reform plan and recommendations of the Lebanon Economic Vision; and Measures to increase the resilience of the financial sector through a stronger Central Bank balance sheet and continuing to build bank capital buffers”[15].

The IMF report recommends the reduction of public deficits through the implementation of the following measures:

-Approval of Fundamental structural reforms is fundamental to boosting growth and improving external competitiveness. IMF projects that “a primary surplus of around 4.5 percent of GDP would be needed to noticeably reduce the debt-to-GDP ratio over the medium to long run. Identifying and agreeing on the measures upfront to support such a plan could provide a lasting boost to confidence. On current plans, about 0.5 percent of the 2019 revenue measures will be permanent, and the authorities’ current electricity plan can yield a further 2 percentage points of GDP in savings over the medium term. The authorities will need to identify and implement additional permanent fiscal measures to achieve the necessary primary surplus”[16].

- Approval and implementation of legislation of key growth-enhancing reforms identified in its CEDRE vision. This includes the implementation of already-approved laws such as the code of commerce[17] and the law on judicial intermediation[18] as well as the approval of a new customs law, regulation on closing a business, bankruptcy law, insolvency practitioner law and law on secured lending and waiving regulatory obstacles to development of industrial zones, and the incorporation of the Council for Development and Reconstruction (CDR) spending in the budget and passing a public procurement law.

-The authorities should review the tools available to cope with financial distress in systemic institutions.

-Fighting corruption through new regulations based on accountability, and productivity.

Conclusion: Are there other alternatives for economic recovery than the SAP?

The official aims of structural adjustment programs are to prevent economic recession. SAPs are a source of conflict between supporters and opponents. Some, such as the IMF and the WB view the program as a necessary procedure to resolve economic crisis and create growth, while others such NGOs and environmental activists oppose the view and focus on the social consequences of the program. The social impact of SAPs is often decried: the poverty stricken are the first victims of SAPs while it has not been proven that free trade is the only means for achieving growth.

The social cost hit more strongly the middle class and poverty stricken populations. Waiving subsidies and liberalizing the price of national currencies, the reduction of salaries and of social benefits lead to the impoverishment of the most vulnerable people in society leading often to demonstrations and sometimes violent protests. Cutting down government social spending will reduce dramatically health care and education for the poor.

Opponents of SAPs programs claim that privatization leads to: A decrease in salary and in job availability; International companies taking over the market and bankrupting small businesses and control of infrastructures.

On the other hand, IMF claims that some countries have succeeded in recovering while others did not. Controversial success stories include Argentina, Egypt, Greece, Tunisia, and Jordan. Although these countries achieved their goals, their citizens were burdened with the costs of such policies. Under the disguise of a free market, public resources were privatized, while government spending dramatically decreased, resulting in a large gap between the wealthy upper class and lower working class...

Finally, an essential factor for the success of the program is government stability. With a stable government the structural adjustment may be implemented amidst popular protest. This is instrumental to the implementation of any SAP program. Yet, it is important to emphasize that the international community should provide other alternative models of financial recovery other than austere structural adjustments programs.

References:

-“IMF loan conditionality and its impact on health financing.” https://eurodad.org/unhealthy-conditions. Retrieved on May 3, 2019.

-“Structural Adjustment, a Major Cause of Poverty” by Anup Shah. http://www.globalissues.org/article/3/structural-adjustment-a-major-cause-of-poverty, Retrieved on May1, 2019.

“How International Monetary Fund and World Bank policies undermine labour power and rights”.

https://www.ncbi.nlm.nih.gov/pubmed/12211286 , Retrieved on June 1, 2019.

-“World Bank and IMF support to dictatorships”.

http://www.cadtm.org/World-Bank-and-IMF-support-to-dictatorships , Retrieved on June 1, 2019.

- Symeon Mavridis, Greece’s Social and Economic Transformation, Democritus University of Trace, 2018.

- International Labor Organization, Case Study of Past Crisis: Lessons Learned from Argentina, Geneva, International Institute for Labor Studies, Joint Discussion Paper Series, 2011.

-"IMF Concessional Financing through the ESAF (factsheet)", April 2004. Retrieved on May 5, 2019.

-IMF, "The IMF's Enhanced Structural Adjustment Facility (ESAF): Is It Working?", September 1999, Retrieved on May 23, 2019.

- IMF, "The Poverty Reduction and Growth Facility (PRGF) (factsheet)". 31 July 2009. Retrieved on May 9, 2019.

-IMF, "IMF Extended Credit Facility (factsheet)", 15 September 2015, Retrieved on May 5, 2019.

[1]-https://www.ukessays.com/essays/economics/sap-has-negatives-impacts-economics-essay.php, Accessed on June1, 2019.

[2]-Paul Colliard, jan Willen, The IMF’s Role in Structural Adjustment, UK, The Economic Journal, 1999.

[3]-David Doyle, Pressures to privatize? , The IMF, Globalization, and Partisanship in Latin America, US, Saga Publications, 2012.

[4]-I Symeon Mavridis, Greece’s Social and Economic Transformation, Democritus University of Trace, 2018.

[5]-Ibid.

[6]-A timeline of Greece’s Recovery, http://dw.com/en/a...of-greeces...recovery/a-45118014-0, Accessed on June 9, 2019.

[7]-Arthur L. Cantonze, The Irish Banking Crisis, Pace University, 2014.

[8]-Honohan, Conner, Kelly et Al., Resolving Banking Crisis, Dublin, Trinity College, 2009.

[9]-Arthur L. Cantonze, Op. Cit.

[10]-Forelle 7 Walter, The Irish Financial Crisis, Dublin, 2010.

[11]Arturo O’ Connell, The Recent Crisis and Recovery of the Argentine Economy, Buenos Aires, 2005.

[12]International Labor Organization, Case Study of Past Crisis: Lessons Learned from Argentina, Geneva, International Institute for Labor Studies, Joint Discussion Paper Series, 2011.

[13]Lebanon, Staff concluding Statement of th 2019 Article IV mission, Beirut, July 2, 2019.

[14]A law was approved but has not been implemented so far.

[15]Lebanon, Staff concluding Statement of the 2019 Article IV mission, Beirut, July 2, 2019.

[16]IMF, World Economic Outlook, IMF Publications, April 2019; Lebanon, Staff concluding Statement of the 2019 Article IV mission, Beirut, July 2, 2019.

[17]- Already implemented,.

[18]- Law already approved but need decrees of application to be implemented.

تصحيح الهيكلية المالية المطبّقة في لبنان

تتناول المقالة موضوع التعديلات البنيوية التي يفرضها صندوق النقد الدولي على البلدان التي تعاني من أزمات اقتصادية حادة مقابل الحصول على قروض من الصندوق. فأبرز هذه السياسات تشمل: تخفيض حجم القطاع العام، تحرير سعر صرف العملة الوطنية، الخصخصة وتخفيض التقديمات الاجتماعية، لبنان لا يشكّل استثناء لهكذا سياسات فـي حال عدم حل مشكلة الدين العام، واعتماد مبادئ التجارة الحرة.

لقد تعرضت سياسات التعديلات البنيوية التي يتبناها صندوق النقد الدولي والبنك إلى العديد من أعمال التقييم والإنتقاد. أما المعيار الأساسي فهو مدى نجاح هذه السياسات التي فـي الواقع نجحت فـي بعض البلدان ورسبت فـي العديد من البلدان الأخرى. أما الانتقاد الأبرز فهو اعتبار أنّ حرية التبادل هي الشرط الأساسي لإعادة النمو إلى البلدان التي تعاني من عجز كبير فـي سياستها العامة. والانتقاد الثاني الأبرز هو كلفة السياسات العامة من الناحية الاجتماعية لأن هذه السياسات تصيب أفراد الطبقات المتوسطة وخاصة الفقيرة منها من خلال سياسات رفع الدعم عن المواد والسلع والخدمات الاجتماعية من دون التأكد من أنّ هذه التضحيات ستفي بالمطلوب. أما بالنسبة للوضع فـي لبنان فإن اعتماد سياسات إعادة هيكلة القطاع العام، وإلغاء بعض سياسات الدعم، والتشجيع على الابتكار كفيلة بحل معظم المشاكل المالية العالقة بشرط أن يكون المجهود موزعًا على كل الفئات كلّ حسب قدراته، وبأن تحصل على حد أدنى من التوافق السياسي.